Monday, February 17 Update

Dear MRPEA Members,

PERS Key Issue-The Unfunded Liability

Last year, the Legislature affirmed its support for paying retirement benefits to active employees and retired members of the system in passing Senate Bill

To do this, the unfunded liability must be reduced. As of June 30, 2024, the unfunded liability of PERS stood at $26.6 billion. It is time for the Legislature to take action to fulfill that commitment. Senate Bill 2439 which recently passed the Senate provides no new funding for PERS. House Bill 1 provides $100,000,000 of the net proceeds from the Mississippi lottery annually to fund PERS until the system’s funded ratio reaches 80%. This meaningful step towards funding the system is appreciated, but additional funding beyond this amount is needed. Message to the Legislature: Fund PERS Now in accordance with actuarial recommendations.

Tier 5

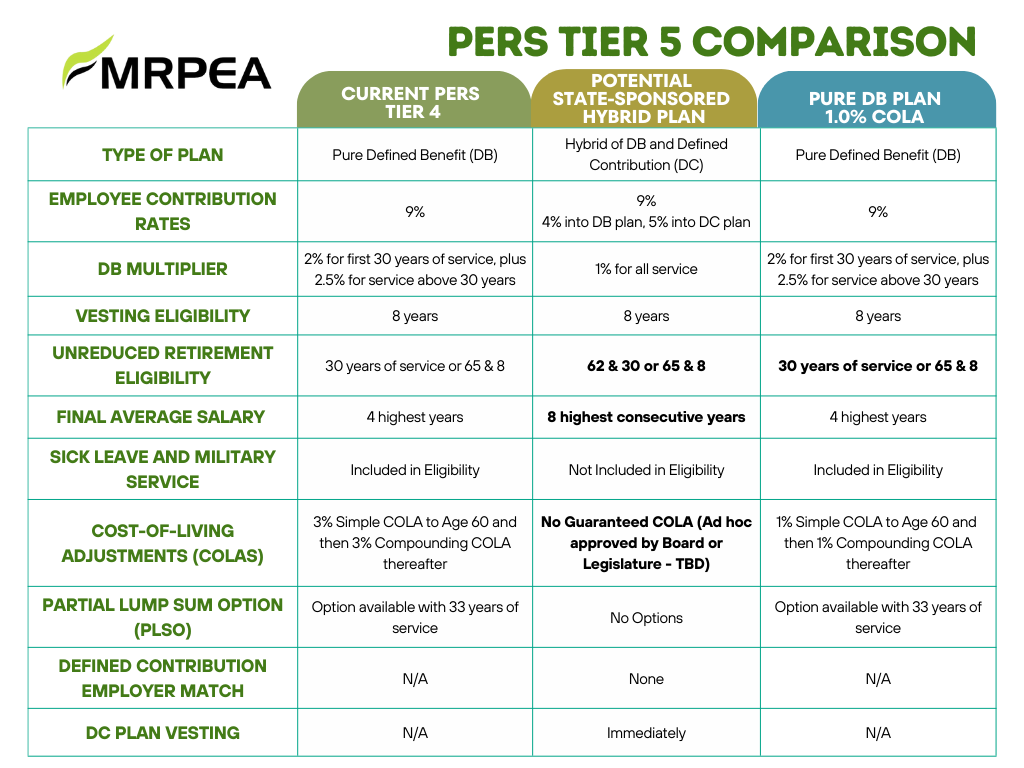

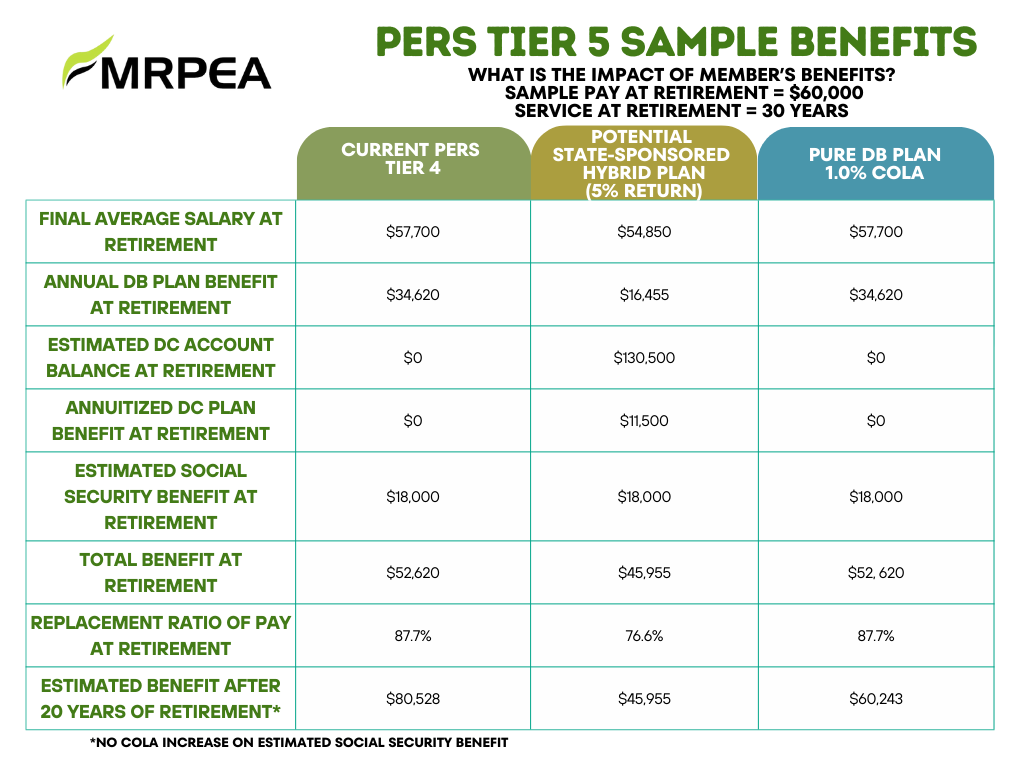

Senate Bill 2439 creates a new Tier 5 Hybrid retirement plan for employees hired on or after March 1, 2026. The new Tier 5 hybrid plan would provide significantly lower benefits to future members with no guarantee that projected benefits will be achieved. The new Tier does not include a guaranteed cost-of-living adjustment (COLA).

The PERS board met in a special called meeting on February 5 to review a Tier 5 defined benefit (DB) plan alternative to the Tier 5 Hybrid plan. The Tier 5 DB plan is comparable to the hybrid plan in terms of its impact on system funding, but it provides substantially higher benefits to future PERS members, and benefits are guaranteed. See below for two chart comparing the two plans. Message to the Legislature: Support the DB plan as the preferred Tier 5 plan option.

Tax Cut Proposals

House Bill 1 eliminates the individual income tax and increases sales taxes to 8.5%. The Senate proposes to reduce the income tax from 4% to 3%. Both bills seek to reduce grocery taxes and increase gas taxes. Retirees in Mississippi, including PERS retirees, do not pay state income tax on distributions from qualified retirement accounts. Reducing or eliminating the individual income tax does not assist them financially. Retirees in Mississippi, including PERS retirees, will pay more taxes under House Bill 1. Further cuts in individual income taxes could lead to shortfalls in General Fund revenues which would negatively impact the state’s ability to fund PERS and other essential government services. Message to the Legislature: Oppose proposed cuts in income taxes and increases in sales taxes.

Contact your state Senators, Representatives, and other key state elected officials now!

Your Elected Officials

Governor’s office (601) 359-3100

Lt. Governor’s office

(601) 359-3200

House Speaker’s office –

(601) 359-3300

Senators and Representatives during session

(601) 359-3770

MS Legislature website: www.legislature.ms.gov for Senator and

Representative contact info, bill status, calendars, committee membership,

and more.

Find your state legislator – www.openstates.org

·

Thank you as always for letting us serve you!

MRPEA