Friday, February 3 Update

Good Morning!

Update on House Bill 605: A member alert was sent out by MRPEA on January 31 regarding the dangers posed by House Bill 605 to the Public Employee Retirement System (PERS) and its beneficiaries. As of 2/2/2023 House Bill 605 has passed out of the House Appropriations Committee and sits on the House calendar. Members are urged to immediately contact their State Representative and Senator to express their concerns regarding this legislation.

What the Bill does:

–It orders that current contribution rates for employees and employers shall not be increased unless authorized by the Legislature.

–It directs PERS to present recommendations for making changes to the retirement system that would apply to future members of the system.

Background: At present, the PERS Board and staff are responsible for ensuring the financial integrity of the retirement system. A vital part of this responsibility involves reviewing and acting on reports and recommendations of the actuary hired by the Board to study and monitor the financial soundness of the system. At its meeting on December 20, 2022, the Board heard recommendations from the actuary and voted based on those recommendations to increase employer contributions during the upcoming year. This action was taken in accordance with the standard operating procedures of PERS.

Talking points when contacting legislators:

–The professional staff and Board of PERS need to make decisions to ensure the financial integrity of PERS.

–Changes do not need to be made to the PERS system that would cut benefits to retirees, now or in the future.

–Retirees oppose House Bill 605

Quick facts on PERS:

–PERS system members total 353,000.

–PERS paid $3.1 billion in retirement benefits last year.

–92 percent of all benefits paid remain in the state.

–Millions in benefit payments flow to virtually every county benefiting Mississippi’s economy at the local and state levels.

–Over the 30-year period that ended June 30, 2022, member contributions and earnings from investments provided 72% of the retirement system’s total funding.

–Each dollar “invested” by Mississippi taxpayers in the plan supports $4.50 in total economic activity in the state.

Resources:

Senators and Representatives during session – 601-359-3770

Measure Search | MISSISSIPPI LEGISLATURE (ms.gov) Read the full text of House Bill 605

Find Your State Legislators – Open States

Author Archives: Emily Pote

Guardian Alert: Concerning House Bill 605 Passes today’s Deadline

We just received word that House Bill 605 has passed the appropriations committee. If voted into law, this bill would allow for the legislature to have veto power over the PERS board. It would greatly hinder the PERS board’s ability to make fiscally responsible decisions for the system, as well as allow the legislature to tie the board’s hands when making contribution increases. We cannot overstate how dangerous this would be for the health of the system. We ask you to call your legislators and let them know that as a PERS member, you do not support this bill! This will affect ACTIVE members just as much as it would retired members as it would jeopardize the health of the system. Please share this with your friends and neighbors and encourage them to call as well!

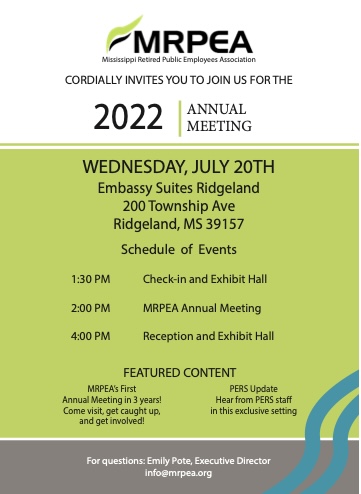

2022 Annual Meeting

Thank YOU MRPEA Members!

I would like to take this opportunity to thank each of you for your membership and to welcome all of our new members to the Mississippi Retired Public Employee Association. MRPEA needs every member we can get to strengthen our voice as there is power in numbers. I am asking each of you to continue to reach out to people you know who are members of the Mississippi Public Employee Retirement System and invite them to become members of MRPEA. It may be someone you go to church with, work with, or a family member. The reason most people are not current members is that they are probably unaware that our organization exists.

There is much work to be done to ensure that our organization is moving forward and growing. If you have a desire to play a role above and beyond membership in making that happen, feel free to reach out to our Executive Director, Emily Pote, and let her know. The Legislature is nearing the end of this year’s Regular Session. I know many of you contacted your local Senator or Representative and expressed your desire to continue the current structure of our benefits. Personal contact with these public servants is very important and key to the success of our mission to protect the financial security and benefits of PERS for current and future retirees.

As the pandemic seems to have quieted somewhat, it is my hope that we are able to hold an annual conference this year. We are currently working on plans to do this in the event it is possible. We will attempt to create an atmosphere that is safe as we all need to remain cautious. If a conference is able to take place, I am hopeful that many of you will be able to attend so we can network together and learn from one another.

The last two years have been very different and trying for all of us. Many of our friends and loved ones have tested positive and some have passed away. Our prayers are with everyone going forward and wish you the very best.

Steven Allen, MRPEA President

New Members

We are working to grow MRPEA so that we can better serve YOU, our member!

Welcome new members! Remember, there is strength in numbers. The power of affiliation gives each member and the group as a whole a recognized voice of leadership to protect and strengthen PERS in the legislature and statewide.

Benny Butts

Beverly Terrell

Mike Roberts

Veronica C Vaughn

Andrew O. Day

Gaye M May

Garrett DeYoung

Judy Savage

Suzanne Shorter

Linda Foshee

David C Lowery

Sam F Swindoll

The Spring Edition of the Guardian is Here

Click HERE to read MRPEA’s Spring 2022 edition of The Guardian

Welcome New MRPEA Members

I would like to take this opportunity to thank each of you for your membership

and to welcome all of our new members to the Mississippi Retired Public Employee

Association. MRPEA needs every member. we can get to strengthen our voice as there is

power in numbers. I am asking each of you to continue to reach out to people you know

who are members of the Mississippi Public Employee Retirement System and invite them

to become members of MRPEA. It may be someone you go to church with, work with, or

a family member. The reason most people are not current members is that they are probably

unaware that our organization exists.

There is much work to be done to ensure that our organization is moving

forward and growing. If you have a desire to play a role above and beyond

membership in making that happen, feel free to reach out to our Executive Director,

Emily Pote, and let her know. The Legislature is nearing the end of this year’s Regular

Session. I know many of you contacted your local Senator or Representative and

expressed your desire to continue the current structure of our benefits. Personal

contact with these public servants is very important and key to the success of our

mission to protect the financial security and benefits of PERS for current and future

retirees.

As the pandemic seems to have quieted somewhat, it is my hope that we

are able to hold an annual conference this year. We are currently working on plans

to do this in the event it is possible. We will attempt to create an atmosphere that

is safe as we all need to remain cautious. If a conference is able to take place, I am

hopeful that many of you will be able to attend so we can network together and

learn from one another.

The last two years have been very different and trying for all of us. Many

of our friends and loved ones have tested positive and some have passed away. Our

prayers are with everyone going forward and wish all of you the best.

—Steven Allen, MRPEA President

Summary of House & Senate Bills

House Bill 531 would:

- Eliminate state income taxes for most taxpayers in 2023 and phase it out totally within about a decade

- Increase the sales tax on most retail items from 7% to 8.5%, an increase of 20%.

- Cut the grocery tax eventually from 7% to 4%

- Cut car tags in half, by using state tax dollars to subsidize local government car tag fees.

Senate Bill 3164 would:

- Phase-out the 4% state income tax bracket over four years. This would mean people would pay no state income tax on their first $26,600 of income, a savings of about $50 a year.

- Reduce the state grocery tax from 7% to 5%, starting in July.

- Provide up to a 5%, one-time income tax rebate in 2022 for those who paid taxes. The

rebates would range from $100 to $1,000.

- Eliminate the state fee on car tags going into the general fund, which would be about $5 off the cost of a new tag, $3.75 for renewals.

2022 Legislative Update

House Bill (HB) 531 would increase the sales tax that all Mississippians pay on

most items by 20% raising the rate from 7% to 8.5%. The House plan would eliminate

state income taxes for most taxpayers in 2023 and phase it out totally in future

years. The state income tax accounts for 1/3 of general fund revenue at present.

If you are at least 59 years old, half Mississippi does not impose income tax

on your retirement income. This includes distributions from 401ks, IRAs, pensions, deferred compensation plans, and Social Security and applies to all Mississippi retirees (in both the private and public sectors). Because your retirement income is already exempt from state income tax, retirees living on a fixed income from these sources will receive no benefit from the elimination of the state income tax while paying 20% more sales tax on most items under HB 531.

The Senate has also filed a tax cut bill: SB 3164. Overall the Senate plan has a number of elements that could benefit PERS members and other retirees but does include a phase-out of the 4% state income tax bracket and up to a 5% one- time tax rebate in 2022 only for those who paid income taxes. Further erosion of the state income tax revenues is not in the best

interest of PERS members. Tax rebates which can be implemented periodically

based on available revenues represent a more prudent approach to managing the

state’s finances. However, these rebates should be made to all Mississippians who filed a tax return, not just those who paid income tax. This would benefit all retirees including PERS members who pay substantial amounts in sales, local and other taxes each year.

Recommended Action

Oppose HB 531. Request amendment of SB 3164 by eliminating the

proposed phase-out of the 4% income tax bracket and making the tax rebate in 2022

available to all Mississippians filing a tax return, not just those who paid income tax.

Contact Speaker of the House, Phillip Gunn, Ways and Means Chairman, Trey Lamar, Lieutenant Governor, Delbert Hosemann, Senate Finance Chairman, Josh Harkins, and your local Representative and Senator at the Capitol Switchboard (601) 359-2220.

What the State Economist’s Office says

The State Economist’s Office has studied the House tax cut plan and

determined that by 2032 it would result in a loss of population and a reduction

in employment and personal income in Mississippi. By 2035 there would be a

reduction in state gross domestic product. These findings have negative implications

for current and future PERS retirees and for the state as a whole.

What state business leaders say

“The Mississippi tax environment was not high profile nor even discussed

significantly as a priority,” said a report released by the Mississippi Economic

Council at the state Capitol on Wednesday, based on dozens of meetings and hundreds

of surveys of business leaders across the state last year.”

“A businessman raised the topic (at one meeting) and dismissed it as a bad

idea (a distraction issue, but not really a hindrance to most businesses).”

State business leaders consider the lack of skilled workers, Mississippi’s image, and problems from the pandemic far more pressing issues.

MRPEA Board Member Obituaries

DR. THOMAS (TOM) H. LOFTIN

Dr. Thomas (Tom) H. Loftin died March 11, 2021, after a long battle with ALS.

He was born on September 28, 1932. He started work in the fall of 1953

teaching chemistry at Myric High School in Jones County. In July 1954 he started working

with the Mississippi Cooperative Extension Service as an assistant county agent and later

associate county agent in Poplarville, MS. In June 1965 the family moved to

Starkville, MS where Tom began working with the Mississippi Cooperative Extension’s

Community Rural Development department at Mississippi State University. He retired as

the state leader for the Department of Community Development in 1986. After retirement, he was a private consultant for ten years, served as secretary of the state Agriculture Economics Association, state vice-president then later state president of the National Association of Retired Federal Employees. He served as director of District 5 of the Mississippi Retired Public Employees’ and is a life member of the board.

DR. ALTON COBB

Dr. Alton Cobb died peacefully at home surrounded by family on October 14, 2021. Dr. Cobb was born on October 19, 1928. He had a career Public Health that spanned 35 years. He first served as a county health director for Sunflower County, and then

as the director of Chronic Disease Services for the MS Department of Health. Dr. Cobb

was an active voice in conversations with Governor John Bell Williams about whether

to bring Medicaid to MS. When that came to pass, Dr. Cobb became the first executive

director of the MS Medicaid Commission. In 1973 he was appointed State Health Officer

for the MS Department of Health, a position he held until 1992.

Once asked by [his wife] Mary what he would wish if granted one last wish,

Dr. Cobb quipped “More affordable and accessible health care for all the people of

Mississippi.” He was practical and principled and uninterested in material possessions and

he spent his life working towards that end.