If you attended public school, community/junior college, or a state university in Mississippi, you were likely taught by a member of the Public Employees’ Retirement System of Mississippi (PERS). Your neighborhood, business, and home are protected by local police and fire departments made up of PERS members. They build many of the roads you travel on each day, inspect food service providers, care for those with mental health needs, heal the sick, and lead ground-breaking research into devastating diseases such as cancer and Alzheimer’s. PERS members protect our children from cyber criminals and serve as advocates for placing our foster children. They are the first on the scene and last to leave when natural disasters strike Mississippi. If you live in Mississippi, your life is touched almost daily by PERS members.

PERS members include not only state employees, but also employees of Mississippi’s public schools, universities, community/junior colleges, counties, and cities. System membership as of June 30, 2023, totaled 361,104 with 115,890 of these individuals retired and receiving benefits. PERS members are an active and vital part of the communities in which they reside, raise their families, pay taxes, and vote. Assuming each PERS member has one significant other, they represent approximately one-third of the voting age population in Mississippi. As elected officials advocate for protection of taxpayers, they may want to remember that PERS members are taxpayers. PERS members who are currently employed contribute 9% of their paychecks for benefits received in retirement.

Last year, $3.3 billion was paid to PERS retirees who spend and invest these dollars in virtually every county and city in Mississippi. Payments to retirees supported 20,000 jobs in Mississippi and generated $265 million in state and local taxes in 2020. Each dollar invested by taxpayers supported $3.59 in economic activity.

The average annual payment per retiree through the PERS retirement plan is just $26,909 per year including the cost-of-living adjustment (COLA). This modest amount, when combined with Social Security, enables retirees to contribute to the state and local economies and avoid living in poverty after paying taxes, health care, and other living expenses. This, in turn, helps the State avoid the inherent public assistance costs it would pay if these individuals lived at or below the poverty level.

Attraction and retention of a qualified workforce are major issues for all Mississippi employers, not just PERS member organizations. While the southern states have seen substantial population growth in recent years, Mississippi’s growth remains flat, and its workforce has declined over the past decade. Our civilian labor force participation rate of 53.9% in October 2023 was the nation’s lowest. While salaries in PERS member organizations are among the lowest in the nation, our retirement system helps PERS employers hire and keep qualified employees.

HB 1590 has passed the Mississippi House of Representatives and is now in the Senate. The approach taken in developing and promoting HB 1590 coupled with the key provisions of the bill have fostered deep concern, distrust, and anger within the PERS community. This bill is viewed unfavorably by PERS members, as would be the case with any other bills that may be drafted containing similar provisions.

The bill abolishes the current 10 member PERS Board effective June 30, 2024. All members of the current PERS Board must be members of PERS. At present, eight board members representing the major membership groups of PERS are elected by statewide ballot to serve six-year terms. The State Treasurer also serves, along with one appointee of the Governor. Members of the current Board possess decades of experience managing complex organizations and financial matters at the state and local levels. Six members are accountants, two are lawyers, and three hold doctorates. They have a deep understanding of PERS acquired over many years that would be lost overnight if HB 1590 is implemented. Board members are advised by some of the best, competitively selected investment managers and actuaries in the country along with PERS staff. Services provided by these experts are formally reviewed on a regular basis. These factors enable the current PERS Board to effectively watch over the complex operations of the retirement system.

The new Board would consist of 11 members including seven direct political appointees: four by the Governor, three by the Lieutenant Governor, none of whom would be required to be members of PERS. The State Treasurer and Commissioner of Revenue (the Governor’s current appointee) would also serve. PERS member representation on the Board would be reduced to one member elected by retirees and one elected by current public employees. Politicization of the PERS Board is viewed in a highly unfavorable light by PERS members. However, it should be noted that the current PERS Board welcomes non-voting advisory members. At present, two members of the Senate appointed by the Lieutenant Governor and two from the House appointed by the Speaker serve as advisors to the Board.

House Bill 1590 does nothing to resolve the key issue facing the system – the need to reduce the unfunded liability. In fact, the bill removes the employer increase recommended by the PERS board, significantly increasing the probability of system insolvency.

At present, PERS has over $33 billion in assets under management and is able to pay benefits well into the future. Over the last 15 years, PERS investment returns have outperformed 98% of public pensions throughout the nation with assets greater than $10 billion. At the same time, PERS pays less in fees to manage these assets than 75% of these pension plans. The plan’s unfunded liability stands at $25.5 billion. It represents the amount earned by and thus owed to retirees and active employees and needs to be reduced much like a mortgage payment over time. With a record surplus, Mississippi is well positioned to honor its commitment to PERS members by making the investment needed to fund PERS properly and maintain current benefits. It should be noted that the Joint Legislative Committee on Performance Evaluation and Expenditure Review (PEER) has concluded that PERS members have a legally protected right to benefits in place at the time they enter the system.

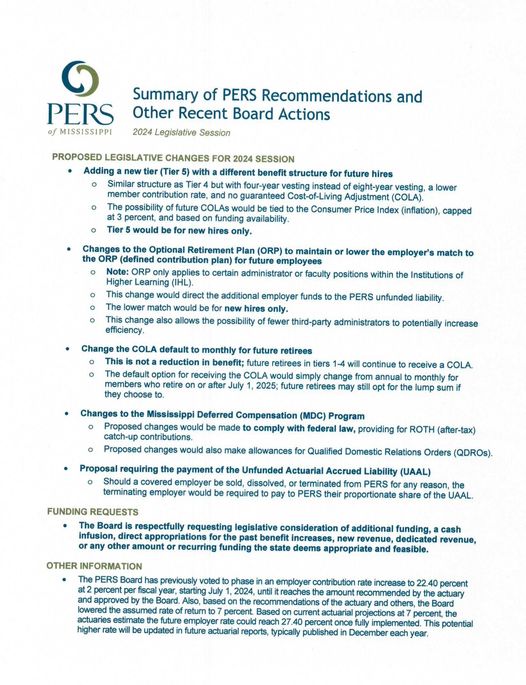

The PERS Board announced plans to phase in a five percent increase in the employer contribution rate over the next three years to help fund PERS. The Board has also requested consideration of a cash infusion or additional funding by the Legislature. MRPEA supports this plan. State-funded entities would pay 77% of the total cost ($371.4 million) of a five percent employer rate increase with non-state-funded entities (counties, municipalities, and others) paying the remaining 23%. It is important to note that only 31% of the state-funded entity employer costs were paid for with General Funds based on a study conducted by PERS at MRPEA’s request in 2020. The remainder was funded with federal and other source funds. Significant cuts in employment of active members (privatization) and the Legislature not funding benefit enhancements that it enacted in prior years have had a significant negative impact on the PERS unfunded liability, which could be offset in part by a cash infusion from the Legislature. These actions together would have positive impacts on the system’s funded status.

PERS is highly complex. The current Board has performed its responsibilities in a professional, competent manner. At a time when stable even-handed leadership possessing many years of institutional knowledge is needed to manage PERS, HB 1590 seeks a sudden termination of the current Board, replacing it with political appointees who do not have to be members of PERS. This disenfranchises PERS members and could negatively impact the sound operation of PERS. MRPEA urges our state elected officials to maintain current retirement benefits including the COLA for retired, active and future members of PERS while retaining the current PERS Board structure.