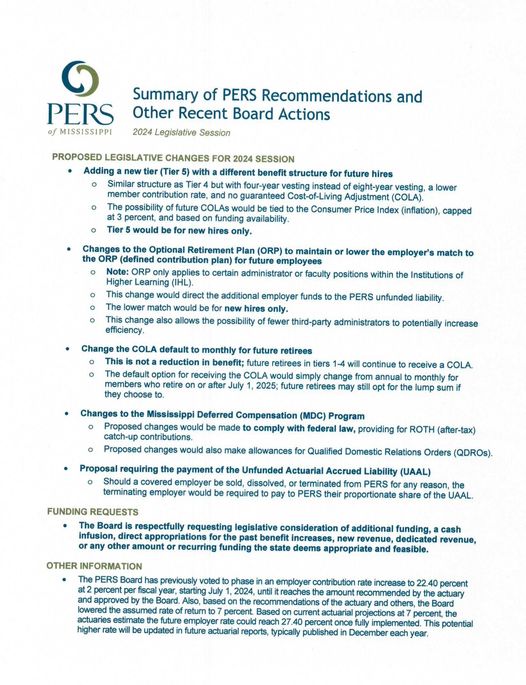

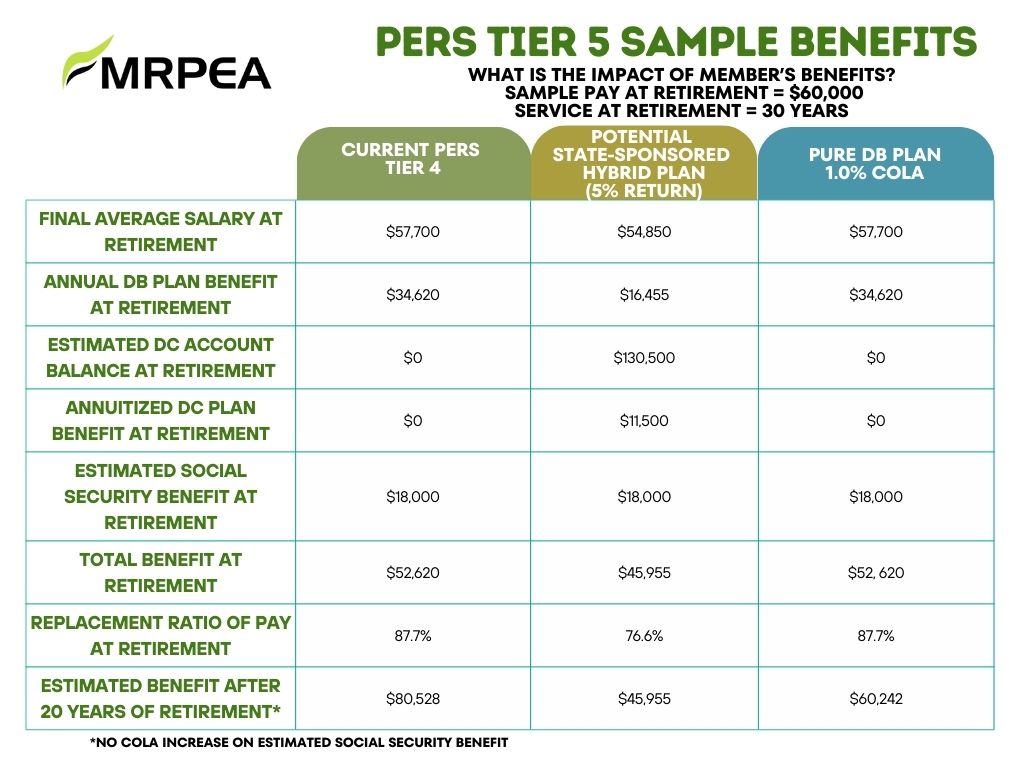

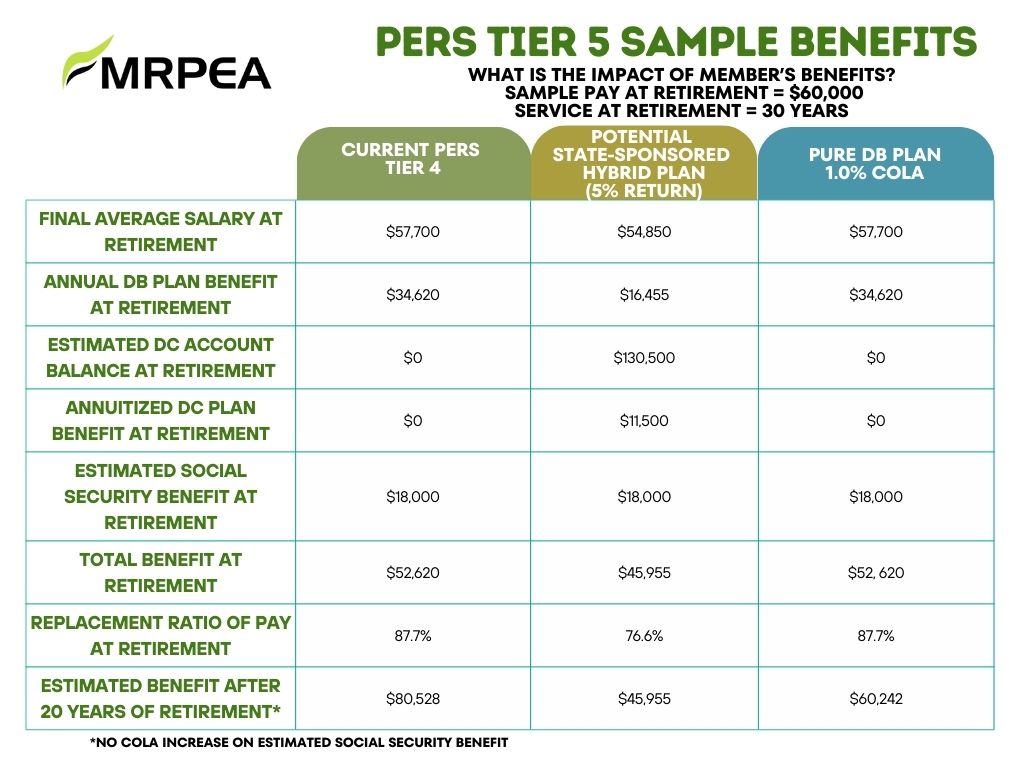

Good morning, Good morning,This week was a historic week for Mississippi due to the shenanigans in Jackson concerning legislation. Despite calls and letters from MRPEA and many of our friends to our Legislative Representatives, the Senate modified the language of the original House Bill 1 replacing it with the Senate’s tax plan that includes eventual elimination of the income tax. At the same time, they also removed the House’s language to divert $100 million per year to PERS until the system funding ratio reaches 80%. The Senate’s income tax plan was more conservative than the House’s plan. Unfortunately, House Bill 1 as returned by the Senate to the House contained technical errors that removed some of the safeguards that the Senate intended to include. In spite of this on Thursday, the House passed House Bill 1, as amended by the Senate, sending it to the Governor who indicated that he would sign the bill. The state’s income tax makes up approximately 28% of the state’s general fund revenue. Elimination of the individual income tax could lead to shortfalls in general fund revenues which would negatively impact the state’s ability to fund PERS and other essential government services. At this time there is no funding for PERS in House Bill 1 and new PERS members will have the Senate’s Hybrid Tier 5 as their retirement system unless legislation is passed to change either of these issues. We must keep making calls and emails to both the House and Senate. Please contact your Legislative members and ask them to: Fund The System. Last year, the Legislature affirmed its support for paying retirement benefits to active employees and retired members of PERS in passing Senate Bill 3231. As of June 30, 2024, the unfunded liability of PERS stood at $26.6 billion. An ongoing multi-year commitment to reducing the unfunded liability of the system must be made, whether it comes from cash infusions, increases in the employer contribution rate beyond those passed during the 2024 Legislative session, or a combination of both. Any funding plan should be constructed in accordance with actuarial recommendations. Support the Defined Benefit Plan Tier 5 option. The PERS Tier 5 hybrid plan would provide significantly lower benefits to future members with no guarantee that projected benefits will be achieved. It does not include a guaranteed cost-of-living adjustment (COLA). The Tier 5 defined benefit (DB) plan alternative to the Tier 5 hybrid plan is comparable to the hybrid plan in terms of its impact on system funding, but it provides substantially higher benefits to future PERS members including a 1% COLA, and benefits are guaranteed. We believe that the DB plan will assist in attracting and retaining Mississippi’s public sector workforce of the future. Charts comparing the two plans appear below.   Sincerely, Sincerely,Bonnie Granger MRPEA President |

Category Archives: News

MRPEA Position Statement On PERS

To the Members of the Mississippi Legislature: To the Members of the Mississippi Legislature:The Mississippi Retired Public Employees’ Association (MRPEA) offers the following thoughts on The Public Employees’ Retirement System (PERS) for your consideration. The Unfunded Liability. Last year, the Legislature affirmed its support for paying retirement benefits to active employees and retired members of the system in passing Senate Bill 3231. To do this, the unfunded liability must be reduced. As of June 30, 2024, the unfunded liability of PERS stood at $26.6 billion. Currently, House Bill 1, as amended by the Senate, provides no new funding for PERS. Senate Bill 2439, as amended by the House, provides $100,000,000 of the net proceeds from the Mississippi Lottery annually to fund PERS until the system’s funded ratio reaches 80%. This meaningful step towards funding the system is appreciated, but additional funding beyond this amount is needed. MRPEA respectfully requests that an ongoing multi-year commitment to reducing the unfunded liability of the system be made, whether it comes from cash infusions, increases in the employer contribution rate beyond those passed during the 2024 Legislative session, or a combination of both. Any funding plan should be constructed in accordance with actuarial recommendations. Tier 5. The new PERS Tier 5 hybrid plan passed by the Senate would provide significantly lower benefits to future members with no guarantee that projected benefits will be achieved. The new Tier does not include a guaranteed cost-of-living adjustment (COLA). The PERS board met in a special called meeting on February 5 to review a Tier 5 defined benefit (DB) plan alternative to the Tier 5 hybrid plan. The Tier 5 DB plan is comparable to the hybrid plan in terms of its impact on system funding, but it provides substantially higher benefits to future PERS members including a 1% COLA, and benefits are guaranteed. We believe that the DB plan will assist in attracting and retaining Mississippi’s public sector workforce of the future. Charts comparing the two plans are attached for your review. MRPEA supports the DB plan as the preferred Tier 5 plan option.   Tax Cut Proposals. The House and Senate have differing proposals on cutting/eliminating the individual income tax in the state. The House also proposes to increase the sales tax. Both chambers seek to reduce grocery taxes and increase gas taxes. ALL retirees in Mississippi, including PERS retirees, do not pay state income tax on distributions from qualified retirement accounts. Reducing or eliminating the individual income tax does not assist them financially. Raising the sales tax from 7% to 8.0% would increase taxes for retirees. Tax Cut Proposals. The House and Senate have differing proposals on cutting/eliminating the individual income tax in the state. The House also proposes to increase the sales tax. Both chambers seek to reduce grocery taxes and increase gas taxes. ALL retirees in Mississippi, including PERS retirees, do not pay state income tax on distributions from qualified retirement accounts. Reducing or eliminating the individual income tax does not assist them financially. Raising the sales tax from 7% to 8.0% would increase taxes for retirees.Further cuts in individual income taxes could lead to shortfalls in General Fund revenues which would negatively impact the state’s ability to fund PERS and other essential government services. State revenues are below estimates and substantial uncertainty exists regarding federal funding and the economy in general. MRPEA opposes cutting/eliminating the income tax along with increasing the general sales tax. Thank you for reviewing and considering this information. Sincerely, Bonnie Granger MRPEA President |

2025 Winter Newsletter: Out Now!

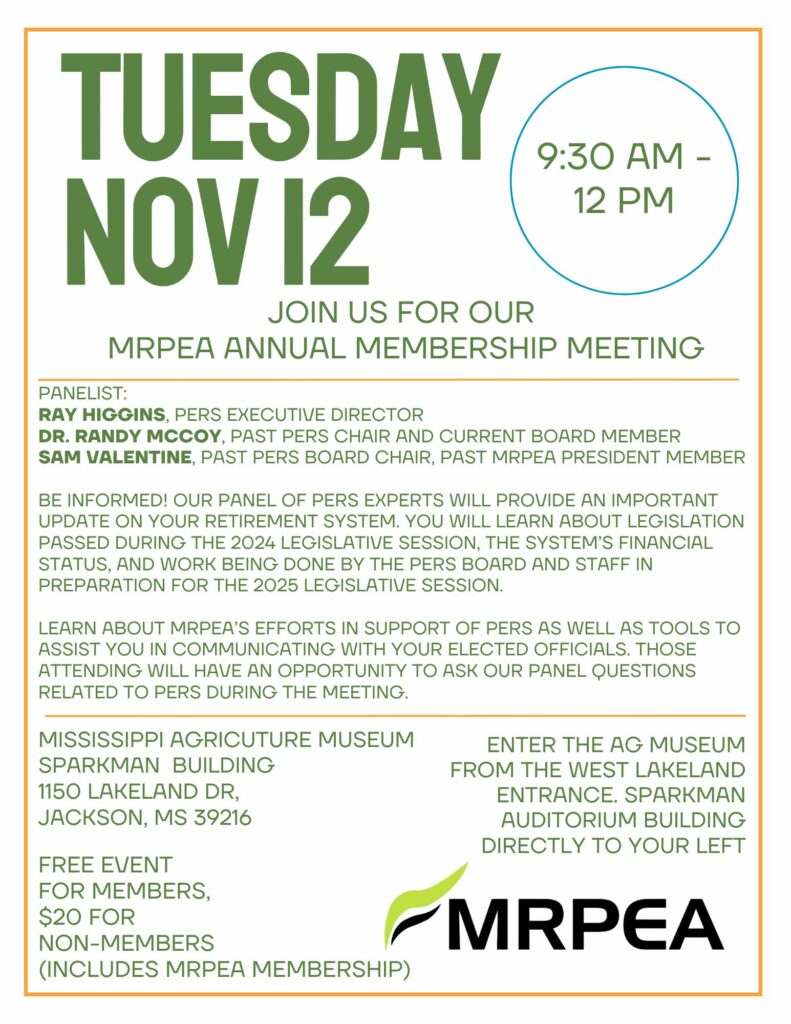

You’re Invited! MRPEA Membership Meeting Nov 12

RSVP at the link Below! https://forms.gle/6hsXHniKFHv7n4TG6

November 12: MRPEA Membership Meeting

STATEMENT FROM THE PERS BOARD OF TRUSTEES

| The statement below is from the PERS Board of Trustees, who asks you to please review, share, forward, post, or distribute. Thank you. Click here to view a shareable PDF of the following statement. |

| The PERS Board opposes House Bill 1590, which restructures the PERS Board with political appointees and prohibits the necessary funding for the retirement system. Why We, as the PERS Board, Object to the New Board Composition HB 1590. –Most of the new trustees would be appointed by politicians rather than elected by the membership. –Any change in leadership for a plan serving roughly 10 percent of the state’s population should be done openly and transparently, free from insinuation that the fund has been mismanaged. –This change has the appearance of an attempt to politicize the PERS Board. –This change would indirectly shift more power to politicians, in effect turning control over to the Governor and Lieutenant Governor, especially since all appointments would be with advice and consent of the Senate. –Currently, eight of 10 PERS trustees are elected by the membership. Under HB 1590, this would be reduced to only two of 11, which significantly disenfranchises more than 300,000 members who are directly impacted by the Board’s management. –Removing most of the current Board members results in the loss of institutional knowledge and continuity. Investments under the Oversight of the Current PERS Board –There are currently more than $30 billion in assets.· –As of June 30, 2023, the 5-, 10-, and 15-year returns exceeded most other public pension plans.· –Ending December 31, 2023, the 15-year return for PERS outperformed 98 percent of other plans in our peer group.· –Last fiscal year, the investment manager fees were only $.31 for every $100 under management; this is less than 75 percent of our peer group. Stability, Continuity, and Resiliency of the Plan under the Oversight of the Current PERS Board· –The current board structure has been in place for many years and the System has proven resilient, continuing to pay benefits through the adversity of the Dot Com Bubble, Great Recession, and the COVID-19 Pandemic.· –The PERS board members are fiduciaries for the trust fund with a sworn duty and loyalty to the membership.· –The current Board has acted with integrity and dedication in carrying out its statutory/fiduciary duties; in administering the benefits as prescribed in law while following the recommendations of multiple actuaries and other expert advisors; in making recommendations to help the situation; and in providing numerous scenarios at the Legislature’s request.· –These actuaries and other advisors are also fiduciaries to the System. HB 1590 Prevents Necessary Funding· –HB 1590 prevents the essential funding as recommended by the actuary. · –As fiduciaries, we believe this is unacceptable.· –The Board’s funding recommendation was for a 5 percent employer contribution rate increase spread over three years and consideration of a cash infusion or additional funding by the Legislature.· –By rejecting the Board’s proposed rate increase, this approach not only would jeopardize the membership, it would also hurt all taxpayers. The longer the plan goes without proper funding, the more it costs and the harder it gets, leaving future citizens with the liability. (See actuarial valuations, www.pers.ms.gov/financial-overview.) It is critically important that you contact your state senator and senators on the Senate Government Structure Committee right away to relay your thoughts on this crucial and time-sensitive matter. |

BREAKING NEWS – You should contact your Senators this weekend

The bill is on the Senate Government Structure Committee calendar and could be acted upon at any time and , if it passes the full Senate, would become law. Contact Senators and the Lt. Governor if you want to stop political appointees from taking control of PERS!

Contact the Senate Government Structure Committee where the bill currently is.

Chairman: Chris Johnson (R) District 45- Forrest, Perry

chjohnson@senate.ms.gov (601)359-2220

Vice-Chair: Jennifer B. Branning (R) District 18 – Leake, Neshoba, Winston

jbranning@senate.ms.gov (601)359-2886

David Blount (D) District 29- Hinds Co.

dblount@senate.ms.gov (601)359-2220

Tyler McCaughn (R) District 31 – Lauderdale, Newton, Rankin, Scott

TMcCaughn@senate.ms.gov (601)359-2220

Sollie B Norwood (D) District 28 – Hinds

snorwood@senate.ms.gov (601)359-2224

David Parker (R) District 2 – DeSoto

dparker@senate.ms.gov (601)359-4088

Daniel H. Sparks (R) District 5 – Itawamba, Prentiss, Tishomingo

DSparks@senate.ms.gov (601)359-3237

MEMBER ALERT-What You Need to Know – House Bill 1590

- House Bill 1590 has passed the Mississippi House of Representatives and is now being considered by the Senate. The bill abolishes the current 10-member PERS board effective June 30, 2024. All members of the current PERS Board have to be members of PERS. At present eight board members representing the membership of PERS are elected by statewide ballot to serve 6-year terms. The State Treasurer also serves along with one appointee of the Governor. Members of the current board possess decades of experience managing complex organizations and financial matters at the state and local levels. This in combination with their deep understanding of PERS enables them to effectively watch over the complex operations of your retirement system.

- The new board would consist of 11 members including seven political appointees: four by the Governor and three by the Lieutenant Governor, none of whom would be required to be members of PERS. The bill also requires the Governor and Lieutenant Governor to consider recommendations for appointees from the Speaker of the House. The State Treasurer and Commissioner of Revenue would also serve. Your representation on the Board would be reduced to one member elected by retirees and one elected by current public employees.

- The current PERS Board announced plans to phase in a 5% increase in the employer contribution rate over the next 3 years to help fund PERS. MRPEA supports this plan. Two percent of that much-needed employer increase was scheduled for this year. House Bill 1590 blocks the increase in PERS funding.

- If House Bill 1590 is enacted into law the PERS board will be controlled by political appointees who have no vested interest in preserving your retirement benefits or representing you. Funding recommended by the current PERS Board and its actuaries will not be provided under this bill. Click here to read the bill. Click here to see how your representative voted.

Contact Your Elected Officials Immediately. Share This Alert With Other PERS Members.

- Message to elected officials – Provide the necessary funding to maintain current retirement benefits including the COLA for retired, active and future members of PERS. Maintain the existing PERS Board structure.

- Governor’s office – (601) 359-3100 | Lt. Governor’s office – (601) 359-3200 | House Speaker’s office – (601) 359-3300

- Senators and Representatives during session – (601) 359-3770

- MS Legislature website: www.legislature.ms.gov for Senator and Representative contact info, bill status, calendars, committee membership, and more.

- Find your state legislator – www.openstates.org

- Join MRPEA and help protect your retirement benefits – https://mrpea.app.neoncrm.com/np/clients/mrpea/membershipJoin.jsp

For All Active and Retiree Members of PERS- ACT NOW!

House Bill 1590 could be taken up by the Rules Committee of the Senate as early as tomorrow morning. Please call, text, or email your Senator tonight or early tomorrow morning and let them know to keep your elected representatives on the PERS Board and make sure that all PERS Board members are members of PERS! If they are members of PERS, they will have a vested interest in keeping all of our benefits both short and long term. It is critical that we act fast and make sure they support keeping our PERS system financially healthy!

The House Bill is located at:

https://billstatus.ls.state.ms.us/…/HB1590_H_Amend_01.pdf

Click below to get information to call your Senators Immediately Please! https://legislature.ms.gov/legislators/senators/