Dear Governor Reeves,

The purpose of this letter is to request that you make provisions in the call for the

upcoming special session as may be necessary for the Legislature to consider funding

needs of the Public Employees’ Retirement System (PERS). I have included a copy of MRPEA’s special session letter to the Mississippi Legislature for your reference.

The Mississippi Retired Public Employees’ Association (MRPEA) has requested that an

ongoing multi-year commitment to reducing the unfunded liability of the system be made

now. The PERS Board has recommended that the employer contribution rate be moved

to 25.92% based on recommendations from three separate actuaries. Based on this

year’s estimates, the difference to increase to 25.92% of payroll from the current 17.9%

equates to roughly $600 million annually.

PERS 368,000 members and their families are counting on elected leaders in our state

to protect their retirement system. Thank you for consideration of this request.

Sincerely,

Bonnie Granger, MRPEA President

Dear Members of the Mississippi Legislature,

House Bill 1 has now passed the House and Senate and has been signed into law by the Governor. The bill over time eliminates the state income tax, which makes up approximately 28% of the state’s general fund revenue. Elimination of the individual income tax could lead to shortfalls in general fund revenues, which would negatively impact the state’s ability to fund PERS and other essential government services. This action was taken despite lagging general fund revenues for the current fiscal year and impending federal budget cuts that will negatively impact Mississippi. While the ultimate depth of budget cuts at the federal level is not known at this time, they will cause significant job losses and funding reductions in our state, which will impact our state’s economy. I remind you that a significant portion of funding for employee positions in the PERS system comes from the federal government.

Last year, the Legislature removed the authority of the PERS board to increase rates that member agencies pay to fund the system, instead giving the final authority to implement rate increases to itself. The Legislature has received two advisory letters from the PERS board confirming the actuary’s recommended employer contribution rate of 25.92% on December 23, 2024, and March 28, 2025. This is based on the PERS actuary’s (CavMac) annual actuarial valuation report dated November 17, 2024, which states: “We recommend that the Board and Legislature consider increasing the Fixed Contribution Rate to the Actuarially Determined Contribution (ADC). This recommendation would remove the phase-in approach altogether, and the contribution rate for the fiscal year beginning July 1, 2026, would be equal to the ADC of 25.92% of annual compensation.” This increase in employer contribution rate equates to roughly $600 million annually. The two additional actuarial firms required by the Legislature agree in substance with the proposed rate and the need for significantly more funding. It should be noted that this recommendation was made before recent declines in the stock market.

Fund PERS. There is currently no funding for PERS in House Bill 1 or elsewhere. The Tier 5 hybrid plan contained in House Bill 1 is not a solution in and of itself to PERS funding needs because it does not begin reducing the unfunded liability for decades. An ongoing multi-year commitment to reducing the unfunded liability of the system must be made now, whether it comes in the form of annual cash infusions from a dedicated source, increases in the employer contribution rate beyond those passed during the 2024 legislative session, or a combination of both. Any funding plan should be constructed in accordance with actuarial recommendations.

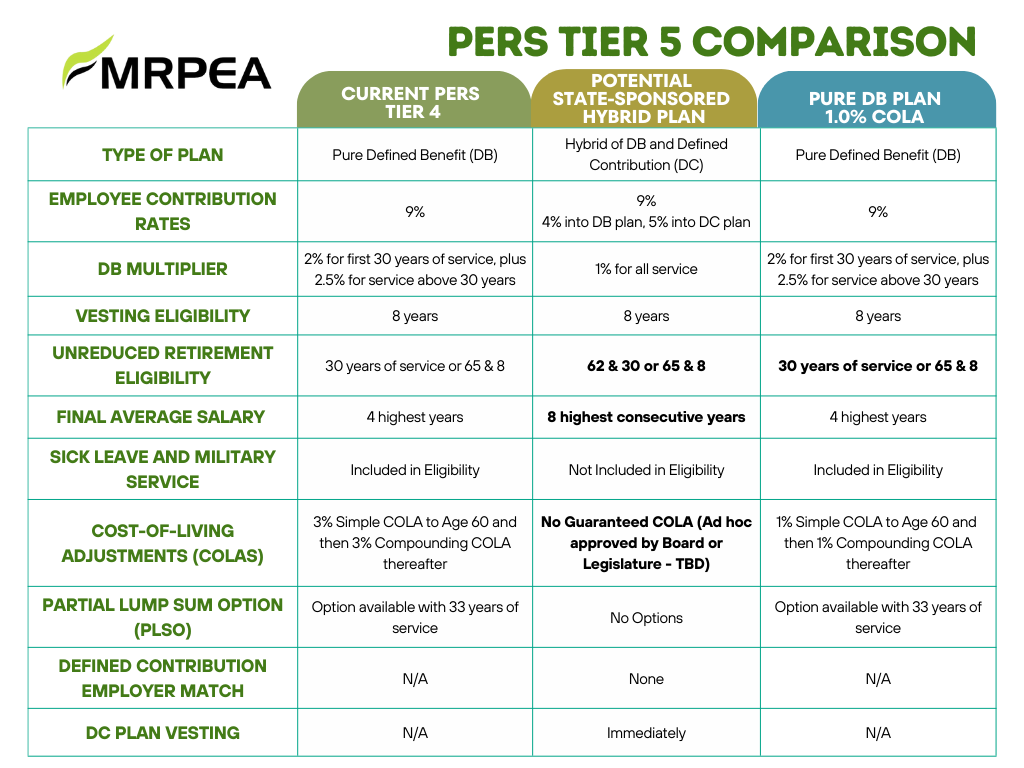

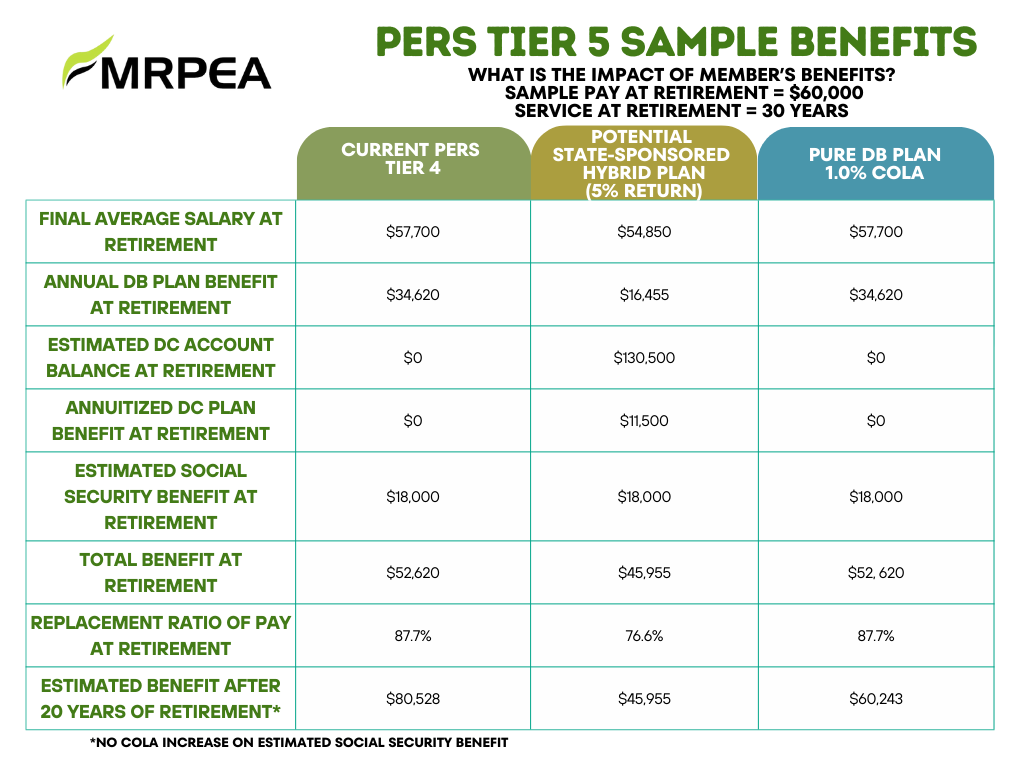

Support the Defined Benefit (DB)Tier 5 Plan Option. The PERS Tier 5 hybrid plan contained in House Bill 1 will provide significantly lower benefits to future members with no guarantee that projected benefits will be achieved. It does not include a guaranteed cost-of-living adjustment (COLA). The Tier 5 DB plan alternative to the Tier 5 hybrid plan, is comparable to the hybrid plan in terms of its impact on system funding, but it provides substantially higher benefits to future PERS members, including a 1% COLA, and benefits are guaranteed. We believe that the DB plan will assist in attracting and retaining Mississippi’s public sector workforce of the future. Charts comparing the two plans are attached.

PERS has 368,000 members. They and their families are counting on you to protect their retirement system. Please honor your promise to pay retirement benefits for active employees and retirees who are members of the system now by funding the system. Support the DB Tier 5 plan for future members of the system.

Sincerely,

Bonnie P. Granger, MRPEA President