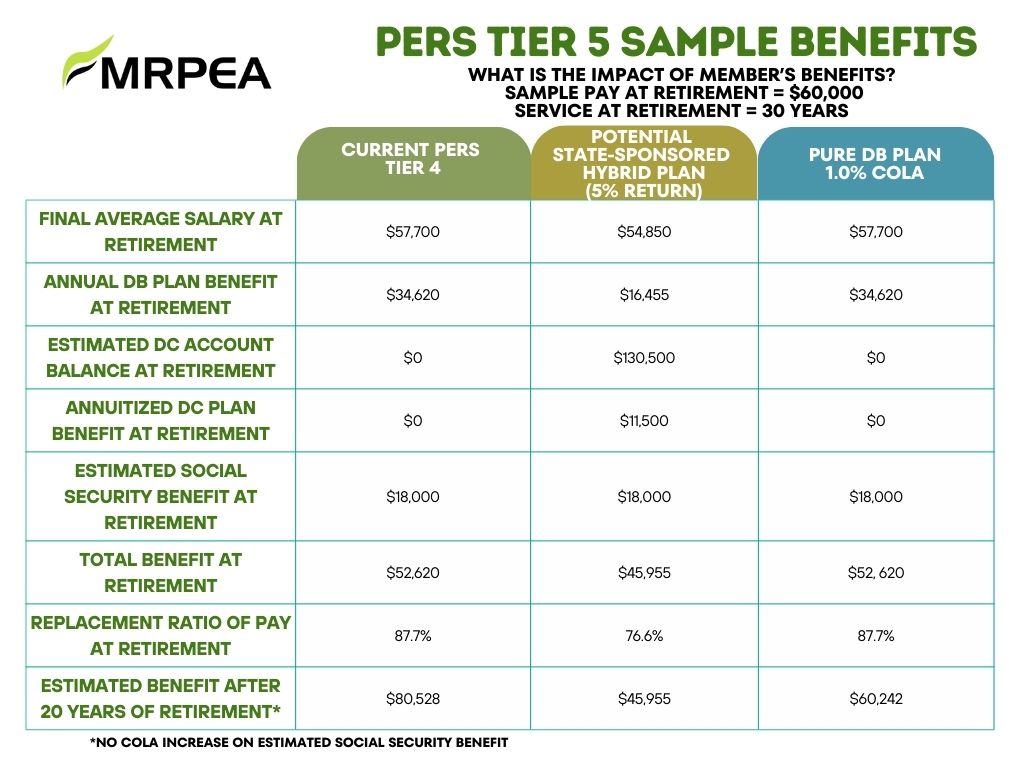

Good morning, Good morning,This week was a historic week for Mississippi due to the shenanigans in Jackson concerning legislation. Despite calls and letters from MRPEA and many of our friends to our Legislative Representatives, the Senate modified the language of the original House Bill 1 replacing it with the Senate’s tax plan that includes eventual elimination of the income tax. At the same time, they also removed the House’s language to divert $100 million per year to PERS until the system funding ratio reaches 80%. The Senate’s income tax plan was more conservative than the House’s plan. Unfortunately, House Bill 1 as returned by the Senate to the House contained technical errors that removed some of the safeguards that the Senate intended to include. In spite of this on Thursday, the House passed House Bill 1, as amended by the Senate, sending it to the Governor who indicated that he would sign the bill. The state’s income tax makes up approximately 28% of the state’s general fund revenue. Elimination of the individual income tax could lead to shortfalls in general fund revenues which would negatively impact the state’s ability to fund PERS and other essential government services. At this time there is no funding for PERS in House Bill 1 and new PERS members will have the Senate’s Hybrid Tier 5 as their retirement system unless legislation is passed to change either of these issues. We must keep making calls and emails to both the House and Senate. Please contact your Legislative members and ask them to: Fund The System. Last year, the Legislature affirmed its support for paying retirement benefits to active employees and retired members of PERS in passing Senate Bill 3231. As of June 30, 2024, the unfunded liability of PERS stood at $26.6 billion. An ongoing multi-year commitment to reducing the unfunded liability of the system must be made, whether it comes from cash infusions, increases in the employer contribution rate beyond those passed during the 2024 Legislative session, or a combination of both. Any funding plan should be constructed in accordance with actuarial recommendations. Support the Defined Benefit Plan Tier 5 option. The PERS Tier 5 hybrid plan would provide significantly lower benefits to future members with no guarantee that projected benefits will be achieved. It does not include a guaranteed cost-of-living adjustment (COLA). The Tier 5 defined benefit (DB) plan alternative to the Tier 5 hybrid plan is comparable to the hybrid plan in terms of its impact on system funding, but it provides substantially higher benefits to future PERS members including a 1% COLA, and benefits are guaranteed. We believe that the DB plan will assist in attracting and retaining Mississippi’s public sector workforce of the future. Charts comparing the two plans appear below.   Sincerely, Sincerely,Bonnie Granger MRPEA President |