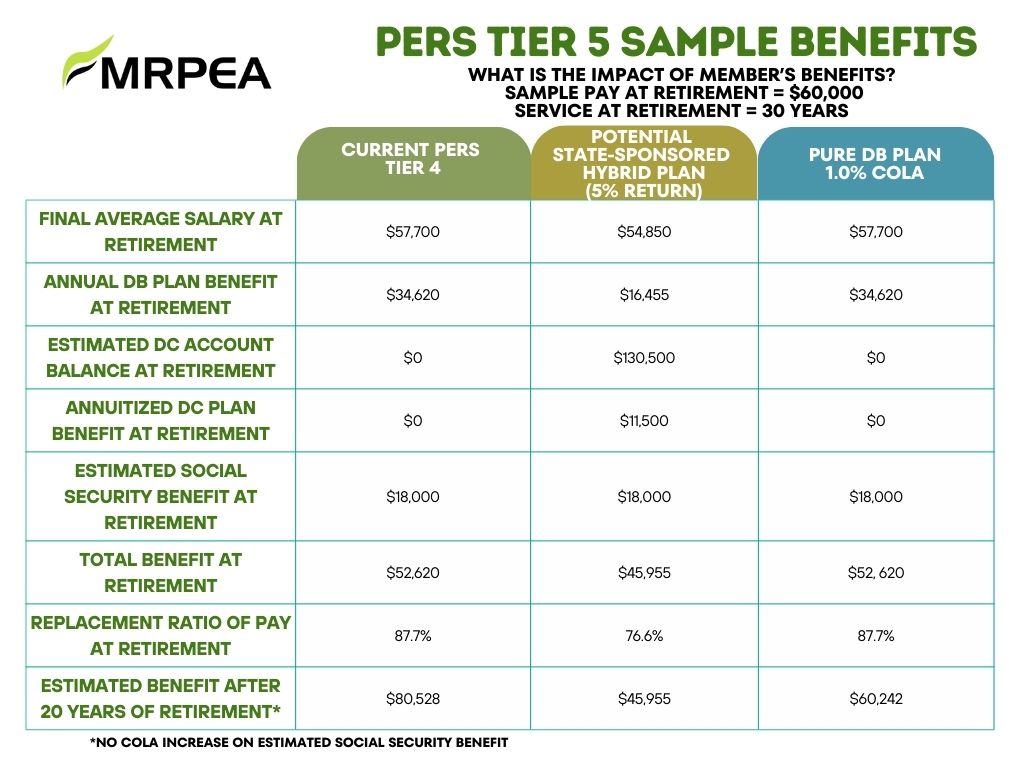

To the Members of the Mississippi Legislature: To the Members of the Mississippi Legislature:The Mississippi Retired Public Employees’ Association (MRPEA) offers the following thoughts on The Public Employees’ Retirement System (PERS) for your consideration. The Unfunded Liability. Last year, the Legislature affirmed its support for paying retirement benefits to active employees and retired members of the system in passing Senate Bill 3231. To do this, the unfunded liability must be reduced. As of June 30, 2024, the unfunded liability of PERS stood at $26.6 billion. Currently, House Bill 1, as amended by the Senate, provides no new funding for PERS. Senate Bill 2439, as amended by the House, provides $100,000,000 of the net proceeds from the Mississippi Lottery annually to fund PERS until the system’s funded ratio reaches 80%. This meaningful step towards funding the system is appreciated, but additional funding beyond this amount is needed. MRPEA respectfully requests that an ongoing multi-year commitment to reducing the unfunded liability of the system be made, whether it comes from cash infusions, increases in the employer contribution rate beyond those passed during the 2024 Legislative session, or a combination of both. Any funding plan should be constructed in accordance with actuarial recommendations. Tier 5. The new PERS Tier 5 hybrid plan passed by the Senate would provide significantly lower benefits to future members with no guarantee that projected benefits will be achieved. The new Tier does not include a guaranteed cost-of-living adjustment (COLA). The PERS board met in a special called meeting on February 5 to review a Tier 5 defined benefit (DB) plan alternative to the Tier 5 hybrid plan. The Tier 5 DB plan is comparable to the hybrid plan in terms of its impact on system funding, but it provides substantially higher benefits to future PERS members including a 1% COLA, and benefits are guaranteed. We believe that the DB plan will assist in attracting and retaining Mississippi’s public sector workforce of the future. Charts comparing the two plans are attached for your review. MRPEA supports the DB plan as the preferred Tier 5 plan option.   Tax Cut Proposals. The House and Senate have differing proposals on cutting/eliminating the individual income tax in the state. The House also proposes to increase the sales tax. Both chambers seek to reduce grocery taxes and increase gas taxes. ALL retirees in Mississippi, including PERS retirees, do not pay state income tax on distributions from qualified retirement accounts. Reducing or eliminating the individual income tax does not assist them financially. Raising the sales tax from 7% to 8.0% would increase taxes for retirees. Tax Cut Proposals. The House and Senate have differing proposals on cutting/eliminating the individual income tax in the state. The House also proposes to increase the sales tax. Both chambers seek to reduce grocery taxes and increase gas taxes. ALL retirees in Mississippi, including PERS retirees, do not pay state income tax on distributions from qualified retirement accounts. Reducing or eliminating the individual income tax does not assist them financially. Raising the sales tax from 7% to 8.0% would increase taxes for retirees.Further cuts in individual income taxes could lead to shortfalls in General Fund revenues which would negatively impact the state’s ability to fund PERS and other essential government services. State revenues are below estimates and substantial uncertainty exists regarding federal funding and the economy in general. MRPEA opposes cutting/eliminating the income tax along with increasing the general sales tax. Thank you for reviewing and considering this information. Sincerely, Bonnie Granger MRPEA President |