House Bill 1590 will be taken up by the Senate’s Government Committee tomorrow, Tuesday, April 2 at 4:00 p.m in room 409. The House of Representatives State Affairs Committee is set to meet at 3:00 p.m. in room 402 tomorrow and will most likely take up Senate Bill 2799, which is rumored to be changed to negatively affect PERS retirees, active, and/or future members’ benefits, and the PERS Board composition. Please call, text, or email your Senators and Representatives tonight or early tomorrow morning and let them know to keep your elected representatives on the PERS Board and make sure that all PERS Board members are members of PERS! If they are members of PERS, they will have a vested interest in keeping all of our benefits both short and long-term. Please also tell them that they should fund the PERS System for the benefits that were promised by the Legislature in the late 1990’s. We must act fast and make sure they support keeping our PERS system financially healthy!

The House Bill is located at:

https://billstatus.ls.state.ms.us/documents/2024/pdf/HB/1500-1599/HB1590PS.pdf

Click below to get information to call your Senators Immediately Please! https://legislature.ms.gov/legislators/senators/

Tag Archives: guardian

2023 PERS Board Retiree Seat Runoff

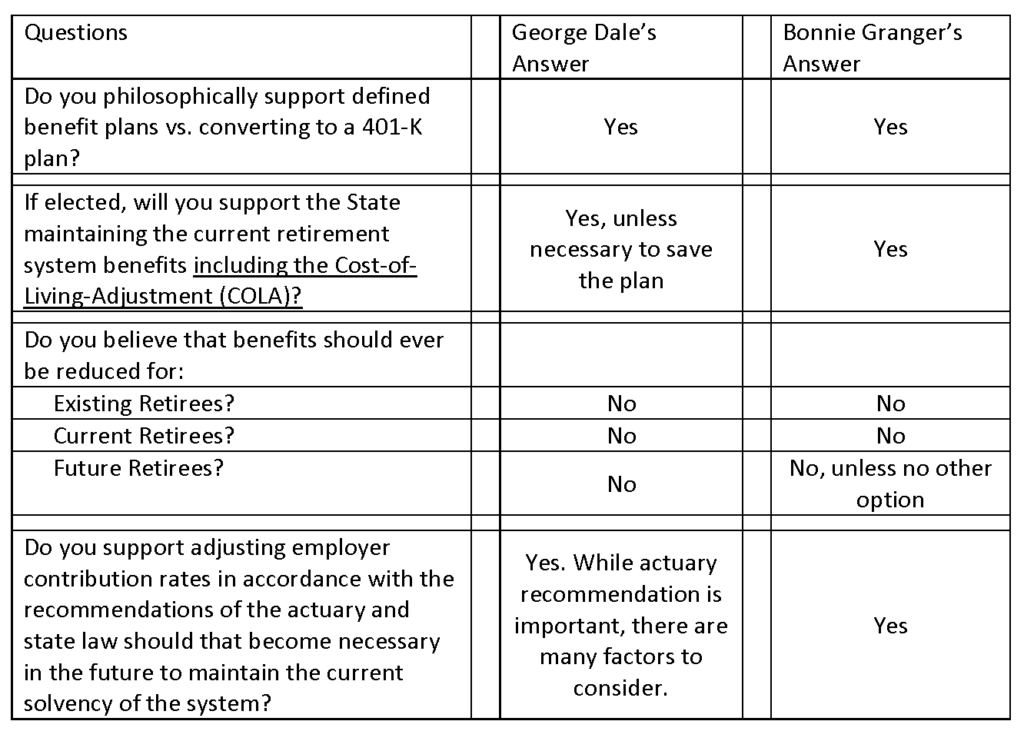

Ballots for the retiree representative to the PERS Board of Trustees will be mailed out on March 17, 2023. The deadline for receipt of ballots is April 21, 2023. The candidates in the runoff are George Dale and Bonnie Granger. Having retired members on the PERS Board that support maintaining existing benefits of PERS for current and future retirees is critically essential. To assist retiree members in making an informed decision, MRPEA is providing Candidate Qualifications, Candidate Surveys, and historical information about the recent vote of the PERS Board to increase employer contribution rates:

Candidate Qualifications: The work of the PERS Board involves complicated financial, legal, and administrative decision-making focused on maintaining the financial integrity and benefits of the retirement system.

George R. Dale (Clinton)

• Mississippi College, master’s

• Mississippi Department of Insurance, commissioner

• Moss Point High School; teacher, coach, and principal

• Administrative Assistant to Governor Bill Waller

I am completing my first term as a member of the PERS Board. It has been an honor to serve. During my term, I have not missed a board meeting. When I started on the Pers Board, we had a cash reserve of approximately 26.5 billion dollars. That amount has increased to around 36 billion dollars. This board has been very conservative with your retirement funds. I have championed the idea that retired teachers collect their pension, but be allowed to work under contract with the public school system. I would appreciate your vote. George Dale

Bonnie J. Granger (Ocean Springs)

• Loyola University School of Law, Juris Doctorate

• University of Southern Mississippi, master’s

• Hattiesburg Public School District, chief financial officer

• Certified Public Accountant

• Attorney, Mississippi and Louisiana

I have vast knowledge and experience in government finance. My career began with the State Auditor’s Office and transitioned into public school district finance, where I served three districts as Finance Director. I received my Bachelor’s and Master’s degrees in Accounting from the University of Southern Mississippi and my law degree from Loyola University. I am a licensed CPA and an attorney in Mississippi. My experience gives me an unparalleled advantage in understanding the PERS system. I strongly support maintaining both the health and member benefits of the PERS system for current and future retirees. Thank you for your support.

Candidate Surveys: MRPEA conducted surveys of each candidate to assess their support for maintaining current retirement system benefits. Members are urged to review the full response of each candidate to the survey. Below are the answers from the survey typed for viewing.

Recent vote of the PERS Board to increase employer contribution rates: At its meeting on December 20, 2022, the PERS Board, based on recommendations of the system’s actuaries and staff, voted to increase employer contributions to make PERS benefits sustainable now and into the future. An excerpt from the PERS Board Meeting Minutes that includes the vote of each member is below for your review.

_____________

Minutes | Board of Trustees

Public Employees’ Retirement System of Mississippi

December 20, 2022 | PERS Board Room

Page 4

Motion: To increase the Public Employees’ Retirement System of Mississippi employer contribution rate from 17.4 percent to 22.4 percent as of October 1, 2023.

• Made by: McCoy.

• Seconded by: Hanna.

• Discussion: None.

• Voting for: Benson, Breland, Hanna, Howard, McCoy, Rutledge, and Smith.

• Voting against: Dale, Graham, and McRae.

• Absent: None.

• Duly Passed

_____________

Please check your mail and complete and return your ballot right away after carefully reviewing all of the information provided here. Make your choice for the person you believe will best serve the interests of current and future retirees. Also, please encourage other retirees to vote as well and share the information provided in this communication. Thank you in advance for your participation in this very important election. Your voice matters!!!

Guardian Alert: WLBT covers HB 605

Mississippi’s retired public employees are raising a red flag about a bill pending at the State Capitol

By Courtney Ann Jackson

Published: Feb. 6, 2023, at 7:21 PM CST

JACKSON, Miss. (WLBT) – Retired public employees are keeping a close watch on the State Capitol. They’re worried a pending bill would insert the legislature into some decision-making for the retirement system.

For some background, public employees around the state pay into Public Employees’ Retirement System of Mississippi, known as PERS. Right now, decisions about how much employees’ current contributions are made by the PERS board. But pending legislation could put the legislature in the middle of those decisions.

House Bill 605 isn’t the same as when Rep. Charles Busby first filed it.

“I filed House Bill 605 as a bill to allow teachers that have retired, come back and teach in the classroom and still draw their retirement,” said Busby during a personal point of privilege on February 1.

Busby started getting flooded with calls and messages, and that’s when he realized it was “hijacked completely.”

“I was never told about it,” Busby said.

The bill went from 30 to 10 pages when it was amended in the appropriations committee. Now its aim? Require the legislature to sign off on any future contribution increases by PERS. It was those changes that spurred the calls to action from the Mississippi Retired Public Employees’ Association.

“When we retired, we were told what our benefits were gonna be,” said retiree and MRPEA board member Sam Valentine. “And we could plan our retirement income around that until, like, the day of our death.”

Retiree and MRPEA board member Sam Valentine says the board makes decisions based on financial advice to maintain the health of the system.

“We’ve got a lot of people who are retired that are elderly,” explained Valentine. “And to hear that there’s something jeopardizing their system is very upsetting to those individuals. And that’s one of the things that we don’t want to happen and hopefully will not happen.”

The association’s past president says the impacts could go beyond those who’ve already retired.

“To be quite honest, and I’m not saying that they necessarily would…but if the legislature would choose not to continue to make the contributions necessary to keep the system actuarily sound, it’s actually going to have more potential bad things happen to the people that are currently working,” described Ed LeGrand, MRPEA Past President.

The PERS board did vote in December to increase the employer contributions from 17.4 to 22.4% beginning in July of next year.

We received this statement from PERS Executive Director Ray Higgins.

“We are closely watching HB 605 and all other legislation that could affect PERS. The PERS Board has historically always acted as fiduciaries in the best interest of the membership, which they did recently when raising the employer contribution rate based on actuarial recommendations. Long term, ensuring the System is adequately funded is critical for those we serve. We are always willing to work with the Legislature, membership, and others for the betterment of PERS.” —Ray Higgins, PERS Executive Director.

The bill hasn’t been taken up by the full House yet. They have until Thursday to do so in order for it to clear the next deadline.

See the article on WLBT’s website below.

https://www.wlbt.com/2023/02/07/mississippis-retired-public-employees-are-raising-red-flag-about-bill-pending-state-capitol/?outputType=amp

Guardian Alert: Update on MS House Bill 605

Friday, February 3 Update

Good Morning!

Update on House Bill 605: A member alert was sent out by MRPEA on January 31 regarding the dangers posed by House Bill 605 to the Public Employee Retirement System (PERS) and its beneficiaries. As of 2/2/2023 House Bill 605 has passed out of the House Appropriations Committee and sits on the House calendar. Members are urged to immediately contact their State Representative and Senator to express their concerns regarding this legislation.

What the Bill does:

–It orders that current contribution rates for employees and employers shall not be increased unless authorized by the Legislature.

–It directs PERS to present recommendations for making changes to the retirement system that would apply to future members of the system.

Background: At present, the PERS Board and staff are responsible for ensuring the financial integrity of the retirement system. A vital part of this responsibility involves reviewing and acting on reports and recommendations of the actuary hired by the Board to study and monitor the financial soundness of the system. At its meeting on December 20, 2022, the Board heard recommendations from the actuary and voted based on those recommendations to increase employer contributions during the upcoming year. This action was taken in accordance with the standard operating procedures of PERS.

Talking points when contacting legislators:

–The professional staff and Board of PERS need to make decisions to ensure the financial integrity of PERS.

–Changes do not need to be made to the PERS system that would cut benefits to retirees, now or in the future.

–Retirees oppose House Bill 605

Quick facts on PERS:

–PERS system members total 353,000.

–PERS paid $3.1 billion in retirement benefits last year.

–92 percent of all benefits paid remain in the state.

–Millions in benefit payments flow to virtually every county benefiting Mississippi’s economy at the local and state levels.

–Over the 30-year period that ended June 30, 2022, member contributions and earnings from investments provided 72% of the retirement system’s total funding.

–Each dollar “invested” by Mississippi taxpayers in the plan supports $4.50 in total economic activity in the state.

Resources:

Senators and Representatives during session – 601-359-3770

Measure Search | MISSISSIPPI LEGISLATURE (ms.gov) Read the full text of House Bill 605

Find Your State Legislators – Open States

Guardian Alert: Concerning House Bill 605 Passes today’s Deadline

We just received word that House Bill 605 has passed the appropriations committee. If voted into law, this bill would allow for the legislature to have veto power over the PERS board. It would greatly hinder the PERS board’s ability to make fiscally responsible decisions for the system, as well as allow the legislature to tie the board’s hands when making contribution increases. We cannot overstate how dangerous this would be for the health of the system. We ask you to call your legislators and let them know that as a PERS member, you do not support this bill! This will affect ACTIVE members just as much as it would retired members as it would jeopardize the health of the system. Please share this with your friends and neighbors and encourage them to call as well!

Thank YOU MRPEA Members!

I would like to take this opportunity to thank each of you for your membership and to welcome all of our new members to the Mississippi Retired Public Employee Association. MRPEA needs every member we can get to strengthen our voice as there is power in numbers. I am asking each of you to continue to reach out to people you know who are members of the Mississippi Public Employee Retirement System and invite them to become members of MRPEA. It may be someone you go to church with, work with, or a family member. The reason most people are not current members is that they are probably unaware that our organization exists.

There is much work to be done to ensure that our organization is moving forward and growing. If you have a desire to play a role above and beyond membership in making that happen, feel free to reach out to our Executive Director, Emily Pote, and let her know. The Legislature is nearing the end of this year’s Regular Session. I know many of you contacted your local Senator or Representative and expressed your desire to continue the current structure of our benefits. Personal contact with these public servants is very important and key to the success of our mission to protect the financial security and benefits of PERS for current and future retirees.

As the pandemic seems to have quieted somewhat, it is my hope that we are able to hold an annual conference this year. We are currently working on plans to do this in the event it is possible. We will attempt to create an atmosphere that is safe as we all need to remain cautious. If a conference is able to take place, I am hopeful that many of you will be able to attend so we can network together and learn from one another.

The last two years have been very different and trying for all of us. Many of our friends and loved ones have tested positive and some have passed away. Our prayers are with everyone going forward and wish you the very best.

Steven Allen, MRPEA President

2022 Legislative Update

House Bill (HB) 531 would increase the sales tax that all Mississippians pay on

most items by 20% raising the rate from 7% to 8.5%. The House plan would eliminate

state income taxes for most taxpayers in 2023 and phase it out totally in future

years. The state income tax accounts for 1/3 of general fund revenue at present.

If you are at least 59 years old, half Mississippi does not impose income tax

on your retirement income. This includes distributions from 401ks, IRAs, pensions, deferred compensation plans, and Social Security and applies to all Mississippi retirees (in both the private and public sectors). Because your retirement income is already exempt from state income tax, retirees living on a fixed income from these sources will receive no benefit from the elimination of the state income tax while paying 20% more sales tax on most items under HB 531.

The Senate has also filed a tax cut bill: SB 3164. Overall the Senate plan has a number of elements that could benefit PERS members and other retirees but does include a phase-out of the 4% state income tax bracket and up to a 5% one- time tax rebate in 2022 only for those who paid income taxes. Further erosion of the state income tax revenues is not in the best

interest of PERS members. Tax rebates which can be implemented periodically

based on available revenues represent a more prudent approach to managing the

state’s finances. However, these rebates should be made to all Mississippians who filed a tax return, not just those who paid income tax. This would benefit all retirees including PERS members who pay substantial amounts in sales, local and other taxes each year.

Recommended Action

Oppose HB 531. Request amendment of SB 3164 by eliminating the

proposed phase-out of the 4% income tax bracket and making the tax rebate in 2022

available to all Mississippians filing a tax return, not just those who paid income tax.

Contact Speaker of the House, Phillip Gunn, Ways and Means Chairman, Trey Lamar, Lieutenant Governor, Delbert Hosemann, Senate Finance Chairman, Josh Harkins, and your local Representative and Senator at the Capitol Switchboard (601) 359-2220.

What the State Economist’s Office says

The State Economist’s Office has studied the House tax cut plan and

determined that by 2032 it would result in a loss of population and a reduction

in employment and personal income in Mississippi. By 2035 there would be a

reduction in state gross domestic product. These findings have negative implications

for current and future PERS retirees and for the state as a whole.

What state business leaders say

“The Mississippi tax environment was not high profile nor even discussed

significantly as a priority,” said a report released by the Mississippi Economic

Council at the state Capitol on Wednesday, based on dozens of meetings and hundreds

of surveys of business leaders across the state last year.”

“A businessman raised the topic (at one meeting) and dismissed it as a bad

idea (a distraction issue, but not really a hindrance to most businesses).”

State business leaders consider the lack of skilled workers, Mississippi’s image, and problems from the pandemic far more pressing issues.

Guardian Alert: July 21, 2020

| Tuesday, July 21 Updates

We have certainly continued to live in unprecedented times. With our state’s COVID-19 numbers setting daily goals, it is more important now than ever to stay up to date on the ever changing information that affects you. We are proud to help with that fight and look forward to serving you through these times. If you haven’t yet, PLEASE make sure you renew your membership. And PLEASE forward this to someone you know who SHOULD be a member. Numbers speak volumes and we need YOU to help our voice be heard. As always, we continue to guard your retirement by monitoring PERS, possible legislation, and keeping a pulse on the state of the system. Thank you for your continued to support. Emily Pote MRPEA Executive Director

New Mask Mandate for 23 counties; 40% of filled ICU Beds contain COVID-19 patients

The PERS Board of Trustees is seeking candidate nominations for its municipal employee representative position. The six-year term will begin January 1, 2021, and end December 31, 2026. Deadline for nominations is 5 p.m., July 27, 2020, JUST 6 DAYS AWAY!!!

Members serving in municipal or county elected office who decide to retire may continue in office at retirement without the required 90-day break in service provided they have reached age 59½. A retiree elected to a municipal or county elected position may either cancel his or her retirement and return to work (accruing additional service credit while receiving the salary for the position) or remain in retirement and waive the salary or receive compensation not to exceed 25 percent of his or her average compensation at retirement. If a retiree chooses to serve in local elected office and continue in retirement, he or she must file annually PERS Form 9C, County/Municipal Elected Official Reemployment Acknowledgement/Election.

The Bipartisan American Miners Act of 2019 reduced the age for in-service distribution from 62 to 59½ for qualified 401(a) plans like PERS. While this federal change was optional for retirement plans to implement, Mississippi law allows municipal and county elected officials to retire and continue in elective service once they have reached the age that will not result in a prohibited in-service distribution as defined by the Internal Revenue Service. That age is now 59½. The member must meet all other vesting requirements for retirement as found in Mississippi law.

Watson asking attorney general whether Mississippi Legislature made it harder to vote in pandemicSecretary of State Michael Watson is asking for an official opinion from Attorney General Lynn Fitch’s office about whether a bill passed by the state Legislature will make it more difficult for Mississippians to vote if COVID-19 is still an issue during the Nov. 3 election. The bill, which was signed into law earlier this month by Gov. Tate Reeves, specifies people can vote early during the pandemic if:

Watson is asking the attorney general to issue an opinion on whether the new language conflicts with existing language that gave local circuit clerks discretion in allowing people to vote early. In May, during a joint meeting of the House and Senate elections committees, Watson said that existing law could be used to allow people to vote early because of concerns about COVID-19 at the discretion of the circuit clerks. The language allowed people to vote early because of “a temporary disability.” Democrats on the committees wanted the law expanded so that the circuit clerks did not have so much discretion on whether to allow people to vote early. But by the same token, many Democrats praised the Republican Watson for saying the language related to “temporary disability” was broad enough so that circuit clerks could interpret it to allow people who did not want to be in a crowded polling place to perhaps vote early. Watson said he was asking for the opinion after Mississippi Today asked whether the new language saying a person had to be in quarantine to vote early meant circuit clerks could no longer use the old language concerning the temporary disability to allow people to vote early to avoid possible exposure to the coronavirus in a crowded precinct on election day. “In an attempt to provide further guidance to our county election officials, our office will be submitting a request to the Attorney General’s office for an official opinion regarding the definition of a ‘physician-imposed quarantine,’ and whether or not that qualifying language removes circuit clerk’s ability to interpret what is included as a ‘temporary disability,’” Watson said in a statement. He said during debate of the bill in the Legislature, supporters of the bill said the excuse to vote early could be granted by “a general statement by a licensed physician or government official, such as the state health officer, advising people to enter into a self-imposed quarantine.” Watson added, “Our goal is to ensure all counties are acting in the best interest of voters while upholding the integrity of the general election.” The Jackson Clarion-Ledger quoted Watson as saying, “The Legislature narrowed it down further than the former law we had.” Senate Elections Chair Jennifer Branning, R-Philadelphia, said “it’s not the intent (of the legislation) to make it harder to vote.” She said that the language referencing the quarantine to vote early should not remove the circuit clerk’s ability to use the “temporary disability” language. House Elections Chair Jim Beckett, R-Bruce, said there was no discussion during the legislative session of trying to prevent the use of the exiting language referencing “temporary disability” to allow people to vote early. “That was never my intent,” he said. Mississippi is among the minority of states that do not have no excuse early voting. In Mississippi, a voter normally must be disabled, over the age of 65 or away from home to vote early by mail or in person. Mississippi also is the only state to require both the request for an absentee ballot and the ballot itself to be notarized. Because of the coronavirus, most states have taken steps to make it easier to vote this November to try to avoid long lines at the polling places and to attempt to curb the spread of COVID-19. Mississippi has taken a few steps, such as giving an absentee ballot five days to arrive at the circuit clerk’s office as long as it is postmarked by election day. The old law required it to be postmarked before election day. And the other significant step was the quarantine language, which in reality, might make it more difficult to vote early. Sen. David Blount, D-Jackson, said the changes made in June are inadequate to deal with the pandemic. He said the Legislature did not do its job to make it easier for Mississippians to vote during the pandemic. “It is the most difficult election process in the country,” he said. “We need to do better.” Watson said he proposed to the Legislature to give the secretary of state the authority to allow people to vote early in person if under an emergency declared by the governor or the president. Legislative leaders rejected the language. Watson said before debate on the voting legislation began in earnest that he supported expanding early in-person voting, but not mail-in voting. The Legislature also opted not to provide about $15 million in federal funds to purchase optical ballot scanner machines for about 68 counties that do not currently have them. Beckett said the purpose of the machines was “reducing our human contact during elections.” Officials said other steps to ensure safety will be taken, such as social distancing, increasing the number of poll workers, requiring poll workers to wear personal protection equipment and continuing sanitizing of the polling places. This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

|

Guardian Alert: July 7, 2020

|

| Tuesday, July 7 Updates

I hope everyone had a safe and happy weekend celebrating this country’s Independence Day. We are watching as much of the state issues mask orders and COVID numbers continue to rise. This week, we give you an update on what schools could look like, in the wake of this pandemic We also bring you an update from the PERS board meeting, as well as the outcome of the most recent PERS Board Election. Thank you for letting us serve you! Emily Pote MRPEA Executive Director MRPEA Attends the June 23 PERS Board Meeting Randy McCoy nominated for vice chair and Chris Howard was elected as the State Representative. Karen Lipscomb and Judy Clark confirmed to serve on the Insurance Committee. PERS will be doing actuarial study on the system this fiscal year. State Auditor conducting performance audit, and engaging PEW to conduct stress tests on our system. The current rate of return for PERS is 7.75, and the audit will most likely assume a lower rate. Possible future legislation on gambling proceeds from truck stops being dedicated to PERS. PERS took a preliminary vote on changing the regulation allowing PERS retirees to be seated in the Legislature without the loss of retirement benefits. Final vote to be taken at next Board meeting on August 25, 2020. The Attorney General has released an Opinion stating that if your annual salary fixed by the MS code it cannot be reduced or waived. This opinion was accompanied by a letter from the AG recommending revocation of the regulation. PERS has been advised that this situation cannot be fixed via a change in regulations, that it must be done via a law change. A precedent already exists in that retired local gov. employees can hold municipal and county elective positions without harming their retirement. We will continue to monitor the situation with the AG’s opinion as we do all thing that affect PERS and YOUR retirement!

The PERS Board of Trustees is seeking candidate nominations for its municipal employee representative position. The six-year term will begin January 1, 2021, and end December 31, 2026. Deadline for nominations is 5 p.m., July 27, 2020. Click here for Nomination Packet

State unveils options for K-12 schools to reopen in the fallby Kayleigh Skinner, Mississippi Today This week the Mississippi Department of Education released guidelines for how K-12 schools should reopen in the fall. In a document titled “Considerations for reopening Mississippi Schools,” the department outlines a three month timeline with information for school districts to consider as they plan for the upcoming school year. These guidelines were created with a group of 10 superintendents across the state, and list three options for how schools should reopen: traditional, hybrid, or virtual. The guidelines will be updated every three months depending on the coronavirus and its effects. The Institutions of Higher Learning already made the decision that the state’s public colleges and universities will “resume traditional operations” in the fall. Traditional reopening would mean students are physically present in school so long as districts can continue to follow Centers for Disease Control and Prevention and state department of health guidelines. This plan suggests schools make adjustments to transportation, screen students daily, and limit student movement and gatherings so that social distancing is possible. Additionally, schools are encouraged to create a plan for students and staff who are unable to come to school due to health issues. A hybrid reopening would mean some combination of in-person instruction and distance learning. Schools could adopt “A/B days,” meaning students would be split into two groups which report to school on alternating days. The guidelines also have the option for elementary students to report to school for in-person instruction, while students in higher grades complete their work through distance learning. Schools could also do some combination of the two options, the guidelines state. Virtual reopening would have students return to school entirely through distance learning, but the guideline warns that districts must take into consideration whether their community has sufficient internet bandwidth and can mitigate “the digital divide among families.” The state is not mandating which option districts take. “Local school districts are responsible for designing school schedules that best meet the needs of their communities,” the department said in a press release. At a Mississippi State Board of Education meeting Thursday, members suspended several policies to help school districts meet requirements and choose one of these three avenues. For example, in the past the department has required that all students receive 5.5 hours of instructional time per day. That has now been reduced to 4 hours. A similar exception was made for high schools that use Carnegie unit credits to measure course completion. Previously, there was a 140-hour instructional requirement for one-credit courses and a 70-hour instructional requirement for half-credit courses. Now, that will be waived as long as districts, “develop a plan to ensure students master the course content,” the press release states. Those plans must be approved by districts’ local school boards and posted to their websites by September 30. Also, school districts no longer have to seek a waiver from the State Board of Education or Commission on School Accreditation if they can’t comply with student-teacher ratios. Some policies that have been in place will remain for the 2020-2021 school year —districts still have to establish graduation requirements that meet the state’s minimum graduation requirements. Before the first day of school, local school districts also have to create criteria for whether a student can move on to the next grade as well as come up with “uniform grading policies,” MDE stated in its press release. If the previous school year is any indication, a hybrid return will likely be popular option. During the 2019-20 school year when school buildings closed because of the pandemic, the department surveyed school districts on how they were delivering instruction. In all, 13 said they were using distance or virtual learning, 16 were sending home packets, and 134 were using a blended approach of the two methods. Five districts said they were using alternative approaches, such as phone calls and peer tutoring, according to the department. Going entirely virtual is a complicated and expensive undertaking the department is actively working on, as the start of a new school year is roughly eight weeks away. Online learning is not currently a reality in many districts. Census Bureau data shows that statewide, almost one-fifth of Mississippi households do not have a computer and nearly one-third don’t have broadband, the federal standard for internet speeds. Last month, State Superintendent Carey Wright presented a digital learning plan to the Mississippi Legislature which highlighted five main areas: technology, curriculum, training, computer security and internet connectivity as resources needed for districts to fully implement a digital learning plan. Requirements would include roughly 300,000 laptops or tablets, 40,000 WiFi hotspots, eight high-quality curricula programs, training for students and families, professional development for 30,000 teachers and 450 technology staff, device management support and software licenses, costing nearly $250 million. The state received millions in federal funds via the Coronavirus Aid, Relief and Economic Security Act which the department intends to use to help pay for this. Gov. Tate Reeves received $34.6 million in a specific fund to be used for education, and the state’s K-12 schools received $169.8 million through the Elementary and Secondary School Emergency Relief Fund. Separately, the Mississippi Legislature has control of $1.2 billion in federal funds to be used for coronavirus relief efforts. To pay for the $250 million price tag, the department has requested $200 million from the Legislature’s portion of federal funds. The Legislature is still in session working out the state budget, so whether the department is granted those funds remains to be seen. To pay for the rest, $33 million would have to come from local school districts’ portion of ESSER funds; $5 million from the department’s CARES Act funds; $5 million from the governor’s portion of education CARES Act funds, and $7 million in private funds were requested from the Mississippi Alliance of Nonprofits, according to the department. “This is such a wonderful opportunity for the state, and…absent COVID-19 and the funding that comes with that, we probably would never have seen this kind of investment in the school districts of Mississippi in my lifetime,” said board member John Kelly during the Thursday meeting. This article first appeared on Mississippi Today and is republished here under a Creative Commons license. |

Guardian Alert: June 30, 2020

|

| Tuesday, June 30 Updates

Well, we’ve officially made it halfway through 2020. As we look towards the next half of this year, we hope that everyone is staying healthy and following all health guidelines and suggestions. Many cities now have mandated face mask orders due to our state’s rising COVID-19 numbers. We continue to watch and listen to our local, state, and federal officials for guidance in this trying times. Thank you for letting us serve you! Emily Pote MRPEA Executive Director

Public retirees likely to lose ability to serve in Legislature without losing retirement benefitsby Bobby Harrison, Mississippi Today The board that governs Mississippi’s public employees retirement system could revisit and reverse its ruling that retired educators and state and local government retirees can serve in the Legislature while continuing to draw their pensions. The Public Employees Retirement System Board had requested an IRS ruling on whether its decision could negatively impact the federal tax exempt status of the system, which could be detrimental for the system and its members. The board had voted in 2019 to change its regulation to allow the public retirees to serve in the Legislature and draw their pension as they do in other states, such as Florida. But in making the change, board members said they needed approval of the IRS. In a letter sent to the PERS Board in early May, officials at the IRS said: “In this particular instance we have determined that we cannot issue a ruling based on the factual nature of the matter involved.” When contacted, the IRS refused to provide any additional details. And PERS officials only referenced the letter and indicated the issue would be discussed by its governing board as early as its next regular meeting on June 23. Members of the House leadership believe the IRS ruling – or lack of ruling – means that the PERS Board will have to reverse its ruling allowing public retirees to serve in the Legislature and draw their pension or risk losing the tax exempt status. “My understanding of the issue is the absence of the IRS endorsement changes everything,” said House Speaker Philip Gunn, R-Clinton. “It puts the tax exempt status of the plan in jeopardy.” House Pro Tem Jason White, R-West agreed. He said if a request is made and the request is not granted: “Isn’t it the same as saying you can’t do that?” The House leadership has opposed the change in regulation to allow public retirees to serve and draw their pension from the very beginning. Gunn argued the PERS change conflicted with existing state law. For years, PERS’ regulations prevented public employees from serving in the Legislature and drawing their pension. But in late 2018, former Attorney General Jim Hood issued an opinion – based on a question from an elective official – saying that public employees could serve in the Legislature and draw their pension as long as they received only a portion of their legislative pay. Public employee retirees already can work part time for other governmental agencies. Hood ruled that they also should be allowed to serve in the Legislature. In the 2019 election, four public retirees – all Republicans – were elected to the House with the expectation that they could draw their pension while receiving partial legislative pay. But the House leadership – despite the PERS change in regulation – refused to reduce the pay of the four members, meaning they were ineligible to receive retirement pay. Two of the four members – Ramona Blackledge, former Jones County tax assessor/collector, and Billy Andrews, former Lamar County judge – already have stepped down from the legislative seats. The other two, Jerry Darnell of DeSoto County and Dale Goodin of Richton, both retired educators, are still serving and forgoing their monthly retirement benefits. “It will eventually be resolved,” Goodin said. “You can’t continue to take people’s rights away.” Goodin and others have argued not allowing retired public employees to serve and draw their pension takes away a right from them that others, such as retirees from the private sector, have. When PERS board members changed the regulation, they did so with the understanding that they might have to rescind the change if not approved by the IRS. Retired public employees in other states are allowed to serve in their legislatures without their system being penalized by the IRS. The four elected officials told Mississippi Today this year that they do not understand why Mississippi is different. For instance, Florida law says specifically “any retired state employee who is presently drawing retirement benefits under any state retirement system may, as any other citizen, serve in the Legislature without affecting in any way his or her retirement status or the receipt of retirement funds while a member of the Legislature.” PERS Executive Director Ray Higgins said earlier the IRS might allow public employee retirees to serve in the legislature in other states without losing their pension and not allow it in Mississippi because “each state has different laws, regulations, and retirement plan designs.” Most employees of state and local governments, public schools K-12 and university employees, participate in Mississippi’s retirement system, contributing 9 percent of their salary for retirement benefits. According to PERS data, the average benefit is more than $23,100 annually for the more than 100,000 people drawing benefits. In total, more than 300,000 are in the public employees retirement system either drawing benefits, having paid into the system or currently paying into the system. This article first appeared on Mississippi Today and is republished here under a Creative Commons license. |

Howard re-elected to PERS Board of Trustees, McCoy voted vice chair Chris Howard, of Madison and executive director of the Mississippi Department of Rehabilitation Services, has been re-elected to the Public Employees’ Retirement System of Mississippi (PERS) Board of Trustees as one of its two state employee representatives.

Howard re-elected to PERS Board of Trustees, McCoy voted vice chair Chris Howard, of Madison and executive director of the Mississippi Department of Rehabilitation Services, has been re-elected to the Public Employees’ Retirement System of Mississippi (PERS) Board of Trustees as one of its two state employee representatives.

Dr. Randy McCoy, retired superintendent of Tupelo Public School District and one of two retiree representatives on the Board, was elected by the Board June 23 to serve as vice chair for fiscal year 2020.

Dr. Randy McCoy, retired superintendent of Tupelo Public School District and one of two retiree representatives on the Board, was elected by the Board June 23 to serve as vice chair for fiscal year 2020.