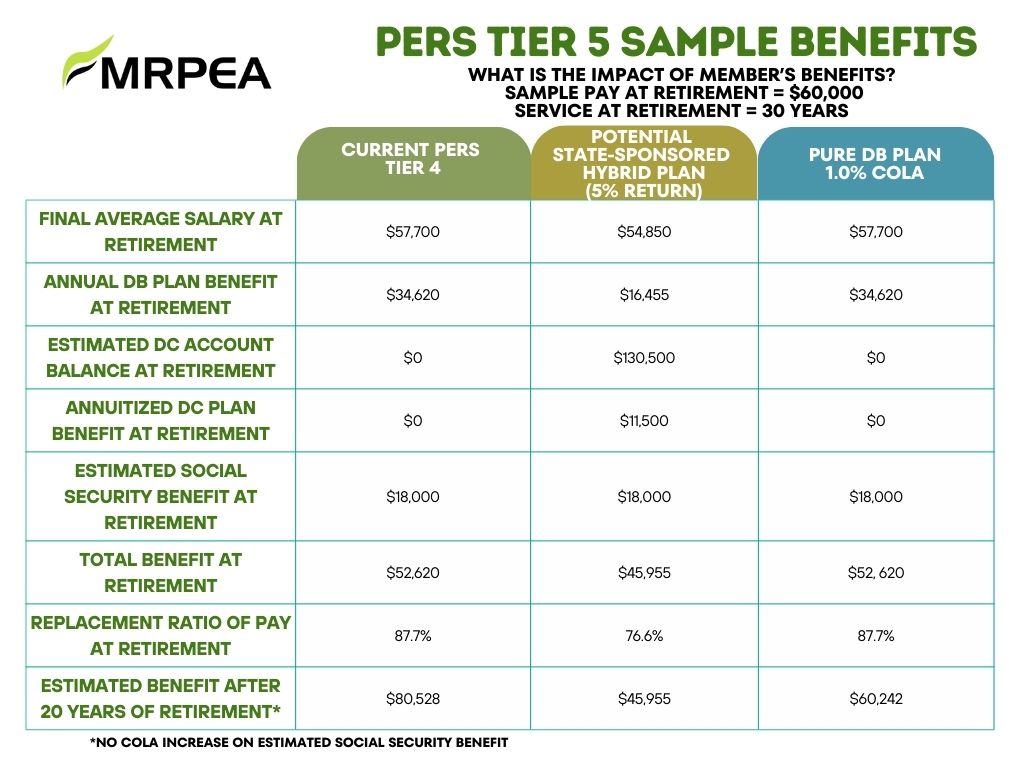

To the Members of the Mississippi Legislature: To the Members of the Mississippi Legislature:The Mississippi Retired Public Employees’ Association (MRPEA) offers the following thoughts on The Public Employees’ Retirement System (PERS) for your consideration. The Unfunded Liability. Last year, the Legislature affirmed its support for paying retirement benefits to active employees and retired members of the system in passing Senate Bill 3231. To do this, the unfunded liability must be reduced. As of June 30, 2024, the unfunded liability of PERS stood at $26.6 billion. Currently, House Bill 1, as amended by the Senate, provides no new funding for PERS. Senate Bill 2439, as amended by the House, provides $100,000,000 of the net proceeds from the Mississippi Lottery annually to fund PERS until the system’s funded ratio reaches 80%. This meaningful step towards funding the system is appreciated, but additional funding beyond this amount is needed. MRPEA respectfully requests that an ongoing multi-year commitment to reducing the unfunded liability of the system be made, whether it comes from cash infusions, increases in the employer contribution rate beyond those passed during the 2024 Legislative session, or a combination of both. Any funding plan should be constructed in accordance with actuarial recommendations. Tier 5. The new PERS Tier 5 hybrid plan passed by the Senate would provide significantly lower benefits to future members with no guarantee that projected benefits will be achieved. The new Tier does not include a guaranteed cost-of-living adjustment (COLA). The PERS board met in a special called meeting on February 5 to review a Tier 5 defined benefit (DB) plan alternative to the Tier 5 hybrid plan. The Tier 5 DB plan is comparable to the hybrid plan in terms of its impact on system funding, but it provides substantially higher benefits to future PERS members including a 1% COLA, and benefits are guaranteed. We believe that the DB plan will assist in attracting and retaining Mississippi’s public sector workforce of the future. Charts comparing the two plans are attached for your review. MRPEA supports the DB plan as the preferred Tier 5 plan option.   Tax Cut Proposals. The House and Senate have differing proposals on cutting/eliminating the individual income tax in the state. The House also proposes to increase the sales tax. Both chambers seek to reduce grocery taxes and increase gas taxes. ALL retirees in Mississippi, including PERS retirees, do not pay state income tax on distributions from qualified retirement accounts. Reducing or eliminating the individual income tax does not assist them financially. Raising the sales tax from 7% to 8.0% would increase taxes for retirees. Tax Cut Proposals. The House and Senate have differing proposals on cutting/eliminating the individual income tax in the state. The House also proposes to increase the sales tax. Both chambers seek to reduce grocery taxes and increase gas taxes. ALL retirees in Mississippi, including PERS retirees, do not pay state income tax on distributions from qualified retirement accounts. Reducing or eliminating the individual income tax does not assist them financially. Raising the sales tax from 7% to 8.0% would increase taxes for retirees.Further cuts in individual income taxes could lead to shortfalls in General Fund revenues which would negatively impact the state’s ability to fund PERS and other essential government services. State revenues are below estimates and substantial uncertainty exists regarding federal funding and the economy in general. MRPEA opposes cutting/eliminating the income tax along with increasing the general sales tax. Thank you for reviewing and considering this information. Sincerely, Bonnie Granger MRPEA President |

Tag Archives: legislature

For All Active and Retiree Members of PERS- ACT NOW!

House Bill 1590 will be taken up by the Senate’s Government Committee tomorrow, Tuesday, April 2 at 4:00 p.m in room 409. The House of Representatives State Affairs Committee is set to meet at 3:00 p.m. in room 402 tomorrow and will most likely take up Senate Bill 2799, which is rumored to be changed to negatively affect PERS retirees, active, and/or future members’ benefits, and the PERS Board composition. Please call, text, or email your Senators and Representatives tonight or early tomorrow morning and let them know to keep your elected representatives on the PERS Board and make sure that all PERS Board members are members of PERS! If they are members of PERS, they will have a vested interest in keeping all of our benefits both short and long-term. Please also tell them that they should fund the PERS System for the benefits that were promised by the Legislature in the late 1990’s. We must act fast and make sure they support keeping our PERS system financially healthy!

The House Bill is located at:

https://billstatus.ls.state.ms.us/documents/2024/pdf/HB/1500-1599/HB1590PS.pdf

Click below to get information to call your Senators Immediately Please! https://legislature.ms.gov/legislators/senators/

STATEMENT FROM THE PERS BOARD OF TRUSTEES

| The statement below is from the PERS Board of Trustees, who asks you to please review, share, forward, post, or distribute. Thank you. Click here to view a shareable PDF of the following statement. |

| The PERS Board opposes House Bill 1590, which restructures the PERS Board with political appointees and prohibits the necessary funding for the retirement system. Why We, as the PERS Board, Object to the New Board Composition HB 1590. –Most of the new trustees would be appointed by politicians rather than elected by the membership. –Any change in leadership for a plan serving roughly 10 percent of the state’s population should be done openly and transparently, free from insinuation that the fund has been mismanaged. –This change has the appearance of an attempt to politicize the PERS Board. –This change would indirectly shift more power to politicians, in effect turning control over to the Governor and Lieutenant Governor, especially since all appointments would be with advice and consent of the Senate. –Currently, eight of 10 PERS trustees are elected by the membership. Under HB 1590, this would be reduced to only two of 11, which significantly disenfranchises more than 300,000 members who are directly impacted by the Board’s management. –Removing most of the current Board members results in the loss of institutional knowledge and continuity. Investments under the Oversight of the Current PERS Board –There are currently more than $30 billion in assets.· –As of June 30, 2023, the 5-, 10-, and 15-year returns exceeded most other public pension plans.· –Ending December 31, 2023, the 15-year return for PERS outperformed 98 percent of other plans in our peer group.· –Last fiscal year, the investment manager fees were only $.31 for every $100 under management; this is less than 75 percent of our peer group. Stability, Continuity, and Resiliency of the Plan under the Oversight of the Current PERS Board· –The current board structure has been in place for many years and the System has proven resilient, continuing to pay benefits through the adversity of the Dot Com Bubble, Great Recession, and the COVID-19 Pandemic.· –The PERS board members are fiduciaries for the trust fund with a sworn duty and loyalty to the membership.· –The current Board has acted with integrity and dedication in carrying out its statutory/fiduciary duties; in administering the benefits as prescribed in law while following the recommendations of multiple actuaries and other expert advisors; in making recommendations to help the situation; and in providing numerous scenarios at the Legislature’s request.· –These actuaries and other advisors are also fiduciaries to the System. HB 1590 Prevents Necessary Funding· –HB 1590 prevents the essential funding as recommended by the actuary. · –As fiduciaries, we believe this is unacceptable.· –The Board’s funding recommendation was for a 5 percent employer contribution rate increase spread over three years and consideration of a cash infusion or additional funding by the Legislature.· –By rejecting the Board’s proposed rate increase, this approach not only would jeopardize the membership, it would also hurt all taxpayers. The longer the plan goes without proper funding, the more it costs and the harder it gets, leaving future citizens with the liability. (See actuarial valuations, www.pers.ms.gov/financial-overview.) It is critically important that you contact your state senator and senators on the Senate Government Structure Committee right away to relay your thoughts on this crucial and time-sensitive matter. |

BREAKING NEWS – You should contact your Senators this weekend

The bill is on the Senate Government Structure Committee calendar and could be acted upon at any time and , if it passes the full Senate, would become law. Contact Senators and the Lt. Governor if you want to stop political appointees from taking control of PERS!

Contact the Senate Government Structure Committee where the bill currently is.

Chairman: Chris Johnson (R) District 45- Forrest, Perry

chjohnson@senate.ms.gov (601)359-2220

Vice-Chair: Jennifer B. Branning (R) District 18 – Leake, Neshoba, Winston

jbranning@senate.ms.gov (601)359-2886

David Blount (D) District 29- Hinds Co.

dblount@senate.ms.gov (601)359-2220

Tyler McCaughn (R) District 31 – Lauderdale, Newton, Rankin, Scott

TMcCaughn@senate.ms.gov (601)359-2220

Sollie B Norwood (D) District 28 – Hinds

snorwood@senate.ms.gov (601)359-2224

David Parker (R) District 2 – DeSoto

dparker@senate.ms.gov (601)359-4088

Daniel H. Sparks (R) District 5 – Itawamba, Prentiss, Tishomingo

DSparks@senate.ms.gov (601)359-3237

MEMBER ALERT-What You Need to Know – House Bill 1590

- House Bill 1590 has passed the Mississippi House of Representatives and is now being considered by the Senate. The bill abolishes the current 10-member PERS board effective June 30, 2024. All members of the current PERS Board have to be members of PERS. At present eight board members representing the membership of PERS are elected by statewide ballot to serve 6-year terms. The State Treasurer also serves along with one appointee of the Governor. Members of the current board possess decades of experience managing complex organizations and financial matters at the state and local levels. This in combination with their deep understanding of PERS enables them to effectively watch over the complex operations of your retirement system.

- The new board would consist of 11 members including seven political appointees: four by the Governor and three by the Lieutenant Governor, none of whom would be required to be members of PERS. The bill also requires the Governor and Lieutenant Governor to consider recommendations for appointees from the Speaker of the House. The State Treasurer and Commissioner of Revenue would also serve. Your representation on the Board would be reduced to one member elected by retirees and one elected by current public employees.

- The current PERS Board announced plans to phase in a 5% increase in the employer contribution rate over the next 3 years to help fund PERS. MRPEA supports this plan. Two percent of that much-needed employer increase was scheduled for this year. House Bill 1590 blocks the increase in PERS funding.

- If House Bill 1590 is enacted into law the PERS board will be controlled by political appointees who have no vested interest in preserving your retirement benefits or representing you. Funding recommended by the current PERS Board and its actuaries will not be provided under this bill. Click here to read the bill. Click here to see how your representative voted.

Contact Your Elected Officials Immediately. Share This Alert With Other PERS Members.

- Message to elected officials – Provide the necessary funding to maintain current retirement benefits including the COLA for retired, active and future members of PERS. Maintain the existing PERS Board structure.

- Governor’s office – (601) 359-3100 | Lt. Governor’s office – (601) 359-3200 | House Speaker’s office – (601) 359-3300

- Senators and Representatives during session – (601) 359-3770

- MS Legislature website: www.legislature.ms.gov for Senator and Representative contact info, bill status, calendars, committee membership, and more.

- Find your state legislator – www.openstates.org

- Join MRPEA and help protect your retirement benefits – https://mrpea.app.neoncrm.com/np/clients/mrpea/membershipJoin.jsp

2024 PERS Legislation Update

PERS has posted a letter on its website to Lt. Gov. Hosemann and Speaker White containing legislative requests and other relevant information that PERS members need to know. Significant changes to the system, such as reducing the annual COLA, are under consideration that could adversely impact current retirees, active employees, and future members of the system.

PERS members are urged to review the letter and specific attachments including Attachment A – One Page Summary and Attachment I – Benefit Scenarios instead of Increased Employer Contributions. A link is provided here to the referenced information:

2024 PERS Legislative Letter to to Speaker of the House of Representatives Jason White and Lieutenant Governor Delbert Hosemann

Attachment A – One-Page Summary

Attachment I – Benefit Scenarios in Lieu of Increased Employer Contributions

Please consider sharing the following message with your state elected officials:

Provide the necessary funding to maintain current retirement benefits for retirees, active employees, and future members of PERS.

Contact Senators and Representatives during the legislative session at 601.359.3770. Contact the Governor’s office at 601.359.3100. For additional information on Senators and Representatives, bill status, legislative deadlines, committee memberships, and more, go to www.legislature.ms.gov.

Please share this information with other members of PERS. Help MRPEA keep you informed on your retirement system – if you are not a member, consider joining by clicking here.

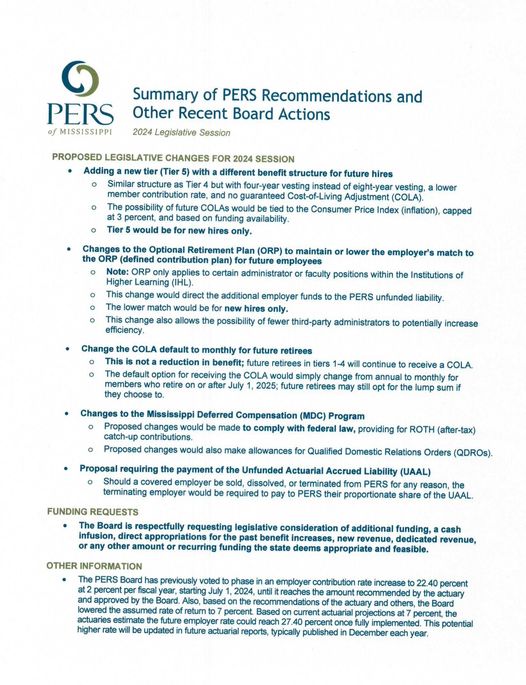

PERS Suggested Legislative Changes

Thank you for your support Brandon Presley!

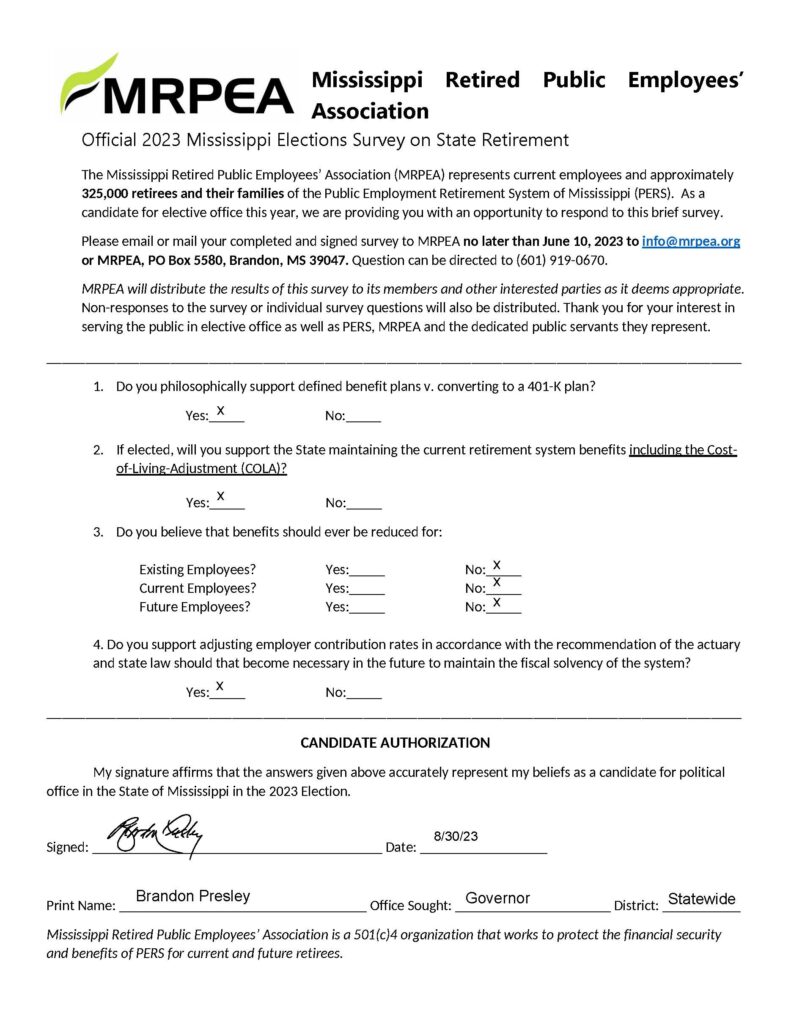

2023 MRPEA Candidate Survey Results

Featured

This spring, MRPEA conducted a survey of all candidates for state positions and state house and senate positions. This survey was designed to determine support or lack thereof for maintaining present benefits for PERS members including retirees, current and future and future employees. The survey was sent to candidates for Gov, Lt Gov. Ag, Treasurer, and Secretary of State as well as members of the Legislature. We encourage you to SEE WHO DID AND DID NOT RESPOND.

Here is the survey that was sent out: 2023 Candidate Survey

Here are the results: 2023 Candidate Survey Results

We also want to share letters from the Candidate for Governor, Brandon Presley, and Lt. Governor Delbert Hosemann, supporting the PERS System.

Guardian Alert: WLBT covers HB 605

Mississippi’s retired public employees are raising a red flag about a bill pending at the State Capitol

By Courtney Ann Jackson

Published: Feb. 6, 2023, at 7:21 PM CST

JACKSON, Miss. (WLBT) – Retired public employees are keeping a close watch on the State Capitol. They’re worried a pending bill would insert the legislature into some decision-making for the retirement system.

For some background, public employees around the state pay into Public Employees’ Retirement System of Mississippi, known as PERS. Right now, decisions about how much employees’ current contributions are made by the PERS board. But pending legislation could put the legislature in the middle of those decisions.

House Bill 605 isn’t the same as when Rep. Charles Busby first filed it.

“I filed House Bill 605 as a bill to allow teachers that have retired, come back and teach in the classroom and still draw their retirement,” said Busby during a personal point of privilege on February 1.

Busby started getting flooded with calls and messages, and that’s when he realized it was “hijacked completely.”

“I was never told about it,” Busby said.

The bill went from 30 to 10 pages when it was amended in the appropriations committee. Now its aim? Require the legislature to sign off on any future contribution increases by PERS. It was those changes that spurred the calls to action from the Mississippi Retired Public Employees’ Association.

“When we retired, we were told what our benefits were gonna be,” said retiree and MRPEA board member Sam Valentine. “And we could plan our retirement income around that until, like, the day of our death.”

Retiree and MRPEA board member Sam Valentine says the board makes decisions based on financial advice to maintain the health of the system.

“We’ve got a lot of people who are retired that are elderly,” explained Valentine. “And to hear that there’s something jeopardizing their system is very upsetting to those individuals. And that’s one of the things that we don’t want to happen and hopefully will not happen.”

The association’s past president says the impacts could go beyond those who’ve already retired.

“To be quite honest, and I’m not saying that they necessarily would…but if the legislature would choose not to continue to make the contributions necessary to keep the system actuarily sound, it’s actually going to have more potential bad things happen to the people that are currently working,” described Ed LeGrand, MRPEA Past President.

The PERS board did vote in December to increase the employer contributions from 17.4 to 22.4% beginning in July of next year.

We received this statement from PERS Executive Director Ray Higgins.

“We are closely watching HB 605 and all other legislation that could affect PERS. The PERS Board has historically always acted as fiduciaries in the best interest of the membership, which they did recently when raising the employer contribution rate based on actuarial recommendations. Long term, ensuring the System is adequately funded is critical for those we serve. We are always willing to work with the Legislature, membership, and others for the betterment of PERS.” —Ray Higgins, PERS Executive Director.

The bill hasn’t been taken up by the full House yet. They have until Thursday to do so in order for it to clear the next deadline.

See the article on WLBT’s website below.

https://www.wlbt.com/2023/02/07/mississippis-retired-public-employees-are-raising-red-flag-about-bill-pending-state-capitol/?outputType=amp