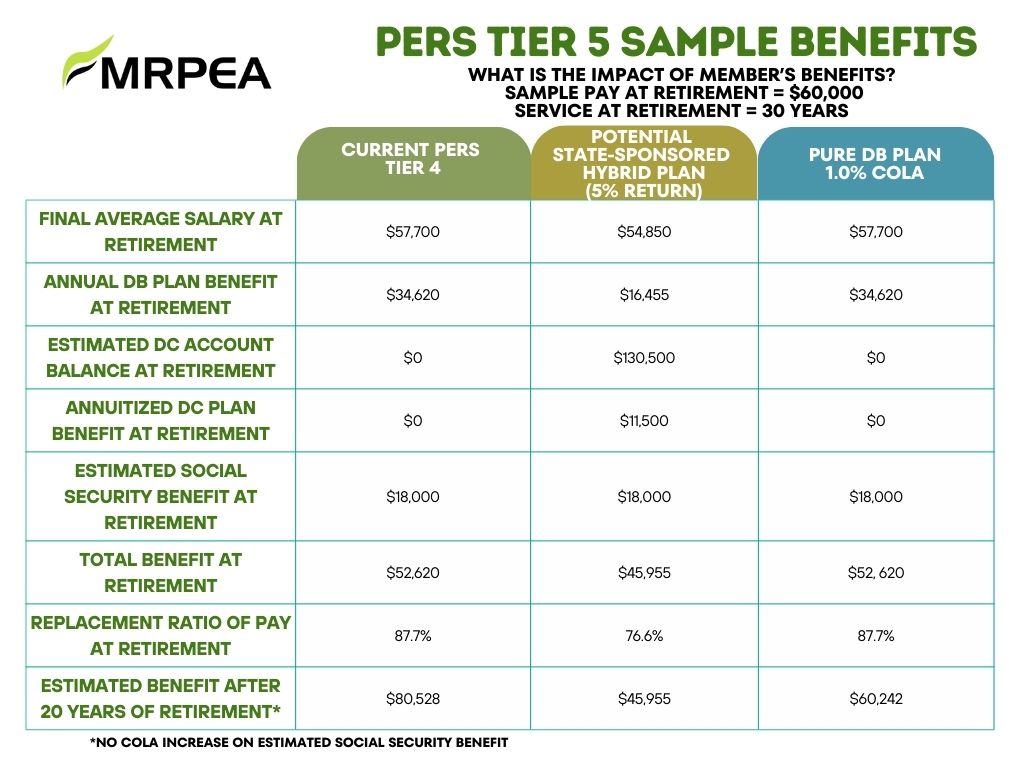

To the Members of the Mississippi Legislature: To the Members of the Mississippi Legislature:The Mississippi Retired Public Employees’ Association (MRPEA) offers the following thoughts on The Public Employees’ Retirement System (PERS) for your consideration. The Unfunded Liability. Last year, the Legislature affirmed its support for paying retirement benefits to active employees and retired members of the system in passing Senate Bill 3231. To do this, the unfunded liability must be reduced. As of June 30, 2024, the unfunded liability of PERS stood at $26.6 billion. Currently, House Bill 1, as amended by the Senate, provides no new funding for PERS. Senate Bill 2439, as amended by the House, provides $100,000,000 of the net proceeds from the Mississippi Lottery annually to fund PERS until the system’s funded ratio reaches 80%. This meaningful step towards funding the system is appreciated, but additional funding beyond this amount is needed. MRPEA respectfully requests that an ongoing multi-year commitment to reducing the unfunded liability of the system be made, whether it comes from cash infusions, increases in the employer contribution rate beyond those passed during the 2024 Legislative session, or a combination of both. Any funding plan should be constructed in accordance with actuarial recommendations. Tier 5. The new PERS Tier 5 hybrid plan passed by the Senate would provide significantly lower benefits to future members with no guarantee that projected benefits will be achieved. The new Tier does not include a guaranteed cost-of-living adjustment (COLA). The PERS board met in a special called meeting on February 5 to review a Tier 5 defined benefit (DB) plan alternative to the Tier 5 hybrid plan. The Tier 5 DB plan is comparable to the hybrid plan in terms of its impact on system funding, but it provides substantially higher benefits to future PERS members including a 1% COLA, and benefits are guaranteed. We believe that the DB plan will assist in attracting and retaining Mississippi’s public sector workforce of the future. Charts comparing the two plans are attached for your review. MRPEA supports the DB plan as the preferred Tier 5 plan option.   Tax Cut Proposals. The House and Senate have differing proposals on cutting/eliminating the individual income tax in the state. The House also proposes to increase the sales tax. Both chambers seek to reduce grocery taxes and increase gas taxes. ALL retirees in Mississippi, including PERS retirees, do not pay state income tax on distributions from qualified retirement accounts. Reducing or eliminating the individual income tax does not assist them financially. Raising the sales tax from 7% to 8.0% would increase taxes for retirees. Tax Cut Proposals. The House and Senate have differing proposals on cutting/eliminating the individual income tax in the state. The House also proposes to increase the sales tax. Both chambers seek to reduce grocery taxes and increase gas taxes. ALL retirees in Mississippi, including PERS retirees, do not pay state income tax on distributions from qualified retirement accounts. Reducing or eliminating the individual income tax does not assist them financially. Raising the sales tax from 7% to 8.0% would increase taxes for retirees.Further cuts in individual income taxes could lead to shortfalls in General Fund revenues which would negatively impact the state’s ability to fund PERS and other essential government services. State revenues are below estimates and substantial uncertainty exists regarding federal funding and the economy in general. MRPEA opposes cutting/eliminating the income tax along with increasing the general sales tax. Thank you for reviewing and considering this information. Sincerely, Bonnie Granger MRPEA President |

Tag Archives: pers

For All Active and Retiree Members of PERS- ACT NOW!

House Bill 1590 will be taken up by the Senate’s Government Committee tomorrow, Tuesday, April 2 at 4:00 p.m in room 409. The House of Representatives State Affairs Committee is set to meet at 3:00 p.m. in room 402 tomorrow and will most likely take up Senate Bill 2799, which is rumored to be changed to negatively affect PERS retirees, active, and/or future members’ benefits, and the PERS Board composition. Please call, text, or email your Senators and Representatives tonight or early tomorrow morning and let them know to keep your elected representatives on the PERS Board and make sure that all PERS Board members are members of PERS! If they are members of PERS, they will have a vested interest in keeping all of our benefits both short and long-term. Please also tell them that they should fund the PERS System for the benefits that were promised by the Legislature in the late 1990’s. We must act fast and make sure they support keeping our PERS system financially healthy!

The House Bill is located at:

https://billstatus.ls.state.ms.us/documents/2024/pdf/HB/1500-1599/HB1590PS.pdf

Click below to get information to call your Senators Immediately Please! https://legislature.ms.gov/legislators/senators/

STATEMENT FROM THE PERS BOARD OF TRUSTEES

| The statement below is from the PERS Board of Trustees, who asks you to please review, share, forward, post, or distribute. Thank you. Click here to view a shareable PDF of the following statement. |

| The PERS Board opposes House Bill 1590, which restructures the PERS Board with political appointees and prohibits the necessary funding for the retirement system. Why We, as the PERS Board, Object to the New Board Composition HB 1590. –Most of the new trustees would be appointed by politicians rather than elected by the membership. –Any change in leadership for a plan serving roughly 10 percent of the state’s population should be done openly and transparently, free from insinuation that the fund has been mismanaged. –This change has the appearance of an attempt to politicize the PERS Board. –This change would indirectly shift more power to politicians, in effect turning control over to the Governor and Lieutenant Governor, especially since all appointments would be with advice and consent of the Senate. –Currently, eight of 10 PERS trustees are elected by the membership. Under HB 1590, this would be reduced to only two of 11, which significantly disenfranchises more than 300,000 members who are directly impacted by the Board’s management. –Removing most of the current Board members results in the loss of institutional knowledge and continuity. Investments under the Oversight of the Current PERS Board –There are currently more than $30 billion in assets.· –As of June 30, 2023, the 5-, 10-, and 15-year returns exceeded most other public pension plans.· –Ending December 31, 2023, the 15-year return for PERS outperformed 98 percent of other plans in our peer group.· –Last fiscal year, the investment manager fees were only $.31 for every $100 under management; this is less than 75 percent of our peer group. Stability, Continuity, and Resiliency of the Plan under the Oversight of the Current PERS Board· –The current board structure has been in place for many years and the System has proven resilient, continuing to pay benefits through the adversity of the Dot Com Bubble, Great Recession, and the COVID-19 Pandemic.· –The PERS board members are fiduciaries for the trust fund with a sworn duty and loyalty to the membership.· –The current Board has acted with integrity and dedication in carrying out its statutory/fiduciary duties; in administering the benefits as prescribed in law while following the recommendations of multiple actuaries and other expert advisors; in making recommendations to help the situation; and in providing numerous scenarios at the Legislature’s request.· –These actuaries and other advisors are also fiduciaries to the System. HB 1590 Prevents Necessary Funding· –HB 1590 prevents the essential funding as recommended by the actuary. · –As fiduciaries, we believe this is unacceptable.· –The Board’s funding recommendation was for a 5 percent employer contribution rate increase spread over three years and consideration of a cash infusion or additional funding by the Legislature.· –By rejecting the Board’s proposed rate increase, this approach not only would jeopardize the membership, it would also hurt all taxpayers. The longer the plan goes without proper funding, the more it costs and the harder it gets, leaving future citizens with the liability. (See actuarial valuations, www.pers.ms.gov/financial-overview.) It is critically important that you contact your state senator and senators on the Senate Government Structure Committee right away to relay your thoughts on this crucial and time-sensitive matter. |

BREAKING NEWS – You should contact your Senators this weekend

The bill is on the Senate Government Structure Committee calendar and could be acted upon at any time and , if it passes the full Senate, would become law. Contact Senators and the Lt. Governor if you want to stop political appointees from taking control of PERS!

Contact the Senate Government Structure Committee where the bill currently is.

Chairman: Chris Johnson (R) District 45- Forrest, Perry

chjohnson@senate.ms.gov (601)359-2220

Vice-Chair: Jennifer B. Branning (R) District 18 – Leake, Neshoba, Winston

jbranning@senate.ms.gov (601)359-2886

David Blount (D) District 29- Hinds Co.

dblount@senate.ms.gov (601)359-2220

Tyler McCaughn (R) District 31 – Lauderdale, Newton, Rankin, Scott

TMcCaughn@senate.ms.gov (601)359-2220

Sollie B Norwood (D) District 28 – Hinds

snorwood@senate.ms.gov (601)359-2224

David Parker (R) District 2 – DeSoto

dparker@senate.ms.gov (601)359-4088

Daniel H. Sparks (R) District 5 – Itawamba, Prentiss, Tishomingo

DSparks@senate.ms.gov (601)359-3237

MEMBER ALERT-What You Need to Know – House Bill 1590

- House Bill 1590 has passed the Mississippi House of Representatives and is now being considered by the Senate. The bill abolishes the current 10-member PERS board effective June 30, 2024. All members of the current PERS Board have to be members of PERS. At present eight board members representing the membership of PERS are elected by statewide ballot to serve 6-year terms. The State Treasurer also serves along with one appointee of the Governor. Members of the current board possess decades of experience managing complex organizations and financial matters at the state and local levels. This in combination with their deep understanding of PERS enables them to effectively watch over the complex operations of your retirement system.

- The new board would consist of 11 members including seven political appointees: four by the Governor and three by the Lieutenant Governor, none of whom would be required to be members of PERS. The bill also requires the Governor and Lieutenant Governor to consider recommendations for appointees from the Speaker of the House. The State Treasurer and Commissioner of Revenue would also serve. Your representation on the Board would be reduced to one member elected by retirees and one elected by current public employees.

- The current PERS Board announced plans to phase in a 5% increase in the employer contribution rate over the next 3 years to help fund PERS. MRPEA supports this plan. Two percent of that much-needed employer increase was scheduled for this year. House Bill 1590 blocks the increase in PERS funding.

- If House Bill 1590 is enacted into law the PERS board will be controlled by political appointees who have no vested interest in preserving your retirement benefits or representing you. Funding recommended by the current PERS Board and its actuaries will not be provided under this bill. Click here to read the bill. Click here to see how your representative voted.

Contact Your Elected Officials Immediately. Share This Alert With Other PERS Members.

- Message to elected officials – Provide the necessary funding to maintain current retirement benefits including the COLA for retired, active and future members of PERS. Maintain the existing PERS Board structure.

- Governor’s office – (601) 359-3100 | Lt. Governor’s office – (601) 359-3200 | House Speaker’s office – (601) 359-3300

- Senators and Representatives during session – (601) 359-3770

- MS Legislature website: www.legislature.ms.gov for Senator and Representative contact info, bill status, calendars, committee membership, and more.

- Find your state legislator – www.openstates.org

- Join MRPEA and help protect your retirement benefits – https://mrpea.app.neoncrm.com/np/clients/mrpea/membershipJoin.jsp

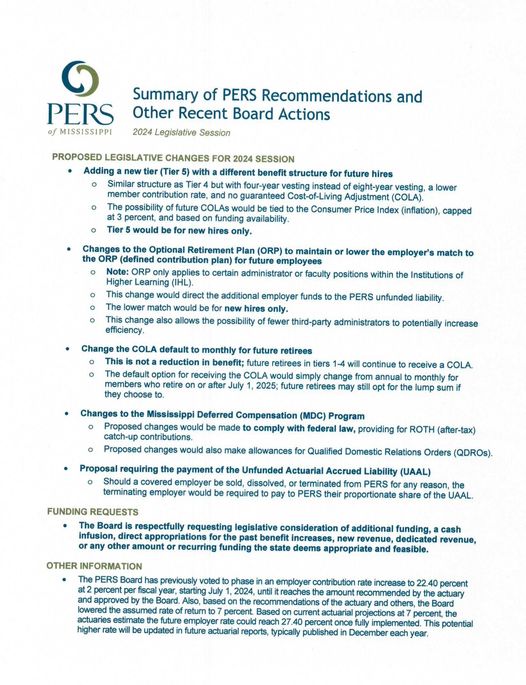

PERS Suggested Legislative Changes

The American South Is Booming. Why Is Mississippi Left Behind? Magnolia State struggles to find workers and stop brain drain

Originally Published in the Wall Street Journal

TUPELO, Miss.—This city of about 38,000 in the northeast part of Mississippi highlights the challenges facing the South’s least populous state. Tupelo offers a charming downtown, tourist attractions and a low cost of living. It has an active local economic-development and job-training effort and is close to large state universities.

Yet even this place, far better off than other parts of the state—and a steady draw for tourists as the birthplace of Elvis Presley—is struggling to attract and retain workers. The area has lost population in recent years. “I love my little town, but if I had the opportunity, I would leave,” said Tayolor Witherspoon, 24, a single mother who works part time as a waitress at D’Cracked Egg breakfast restaurant.

Mississippi faces a shrinking workforce problem—with people of working age on the sidelines and younger people moving away—as it also struggles to attract new residents. Economic and population growth is transforming other Southern states such as neighboring Tennessee.

State and local leaders worry Mississippi’s civilian labor-force participation rate—the nation’s lowest, at 53.9% in October, compared with 62.7% overall in the U.S.—as well as a substantial brain drain of young people moving away and a shrinking workforce are hurting the state’s chances of joining in the region’s bonanza.

From the summer of 2022 to the summer of 2023, the U.S. population grew by 1.6 million people, with 1.4 million of them—almost 87%—in the South, according to U.S. Census Bureau estimates. But Mississippi essentially missed out on that growth. It gained just over 750 residents during the same period.

This October, according to U.S. Bureau of Labor Statistics data, Mississippi’s civilian labor force had shrunk 1.4% from what it was a decade earlier, even as the South’s workforce overall has grown exponentially. For example, neighboring Tennessee’s labor force increased almost 11% for the same period.

About 12.6% of the state’s population under the age of 65 have a disability, compared with 8.9% overall in the U.S., according to Census Bureau estimates. Mississippi’s unemployment rate hit record lows in 2023, even as the overall size of its labor force shrank and a large percentage of its residents who were of working age weren’t working.

Republican Gov. Tate Reeves, in an interview with The Wall Street Journal, attributed brain drain and the low labor force participation to several factors. He pointed to public employees being able to retire after 25 years while still earning large pensions—and that Mississippi’s low cost of living allowed families to earn enough income with only one spouse’s holding a job, further reducing labor force participation.

Reeves also said that many millennials want to move to a large city after college and that troubles in the capital city of Jackson, the largest city, have pushed many to leave the state.

“What has certainly been a struggle in Mississippi compared to other states is the lack of a major metropolitan area to attract young people,” Reeves said, calling Jackson’s revitalization a major goal. He is about to assume his second term after defeating Democratic challenger Brandon Presley last fall.

Southern cities such as Nashville, Tenn., Charlotte, N.C., and Atlanta experienced a population rise in recent years, with younger people drawn by amenities such as major sports teams, entertainment venues, new restaurants and bars, and robust universities and colleges. Jackson has seen its population decline from 173,500 in 2010 to 146,000 in 2022, according to Census estimates.

Political battles between Mississippi’s white Republican leaders and Black Democratic officials from Jackson have contributed to increased racial tensions. The two sides are locked in a political battle over control of the capital city’s troubled water supply and part of its criminal justice system. It also has a relatively high crime rate.

Reeves said he wanted to bring more higher-paying jobs to the state with efforts such as AccelerateMS, the workforce development agency created in 2021. The state needs employees with college degrees, but it also needs a pool of skilled blue-collar workers, including welders and truck drivers, he added.

Bill Cork, executive director of the Mississippi Development Authority, questioned some of the bleak federal statistics about the state, but said bringing more Mississippians into the workforce was a big challenge. He pointed to Mississippi’s relatively high percentage of people who are incarcerated and who are on public assistance as factors in the state’s low civilian labor-force participation rate. The state has had one of the highest poverty rates in the nation for years, according to federal data.

About 24% of Mississippi residents 25 years or older hold some kind of college degree, more than 10 percentage points below the national average, according to data from the Census Bureau. Only about half of the graduates from Mississippi’s public universities work in the state three years after graduation. Many leave for growing metropolitan areas in other parts of the South, according to the office of Shad White, the state’s Republican auditor, whose office has studied the brain drain problem.

“We might as well cut a check to Atlanta every year,” White said of Mississippi taxpayers.

Jamiko Deleveaux, director of the University of Mississippi’s Center for Population Studies, said he worried that when older workers in the state start retiring in coming years, high rates of people moving away and low rates of migration and immigration into the state could cause an even more dire economic problem.

Some positive signs have appeared, however: Steel Dynamics said last year it would invest $2.5 billion in the state, creating 1,000 jobs in eastern Mississippi, south of Tupelo. The state won projects totaling $5.4 billion in capital investment in 2022, a record amount, according to the Mississippi Development Authority.

Mississippi has seen increased corporate investment, some improved school test scores and other hopeful signs in recent years. The state and local agencies also have launched and expanded workforce-development programs.

Famous as the boyhood home of the king of rock ‘n’ roll, Tupelo has a relatively low cost of living and a lower crime rate than other parts of the South.

Tupelo sits close to large state universities, the University of Mississippi in Oxford and Mississippi State University in Starkville, which produce thousands of graduates each year. Some settle in the area. The region has suffered job losses in its once-healthy furniture manufacturing sector, but a nearby Toyota plant, opened in 2011, has brought good-paying jobs and spin-off businesses.

The Community Development Foundation, an economic development effort funded by government and businesses in Tupelo and Lee County, has revitalized its programs for young professionals and built a successful high school outreach effort among its initiatives to recruit and retain workers.

Still, Tupelo faces challenges on the road ahead: Census estimates show the city lost population in 2022 since 2020.

Maddin Hutto, the foundation’s public-relations director, who also heads up its revamped young professionals group, said she goes to area universities and colleges to find potential employees for local businesses. “It’s still a hard sell, for sure,” she said.

A furniture company with headquarters in the area closed in 2022, putting 2,700 people—including many in Mississippi—out of work. But Tupelo can tout the success of Hyperion Technology Group, which focuses largely on developing highly sensitive acoustic equipment for defense agencies and law enforcement.

President and co-founder Geoff Carter said that the 60-employee company raised salaries and provided stronger benefit packages to match what competitors in other parts of the country are offering.

Carter says that he gets offers to buy his company and move it out of state every week, but he has no plans to do so, he said.

Emily Donegan, 42, a nurse who has lived in the Tupelo area most of her life, said that Mississippi lacks a big city that is fun to visit and that salaries are often higher in other regions.

“ If I was younger, phfffft,” she said, motioning her thumb outward. “I would go.”

The single mother said her daughter is attending a local community college and plans to go on to university. Once she’s finished school, Donegan plans to leave.

“My five-year plan is to be somewhere different—and her too,” she said.

- Harriet Torry contributed to this article.

Write to Cameron McWhirter at Cameron.McWhirter@wsj.com

MRPEA Candidate Forum

Join us Tuesday, September 12 from 1 pm-3pm at the Mississippi Agriculture Museum in the Forestry Auditorium.

We are excited to list our confirmed speakers:

- Brandon Presley, Democratic nominee for Governor

- Greta Martin, Democratic nominee for Attorney General

- D. Ryan Grover, Democratic nominee for Lt. Governor

- Addie Green, Democratic nominee for Treasurer

- David Blount, Senate representative on PERS Board

- Brian Rhodes, Republican nominee for Senate District 36

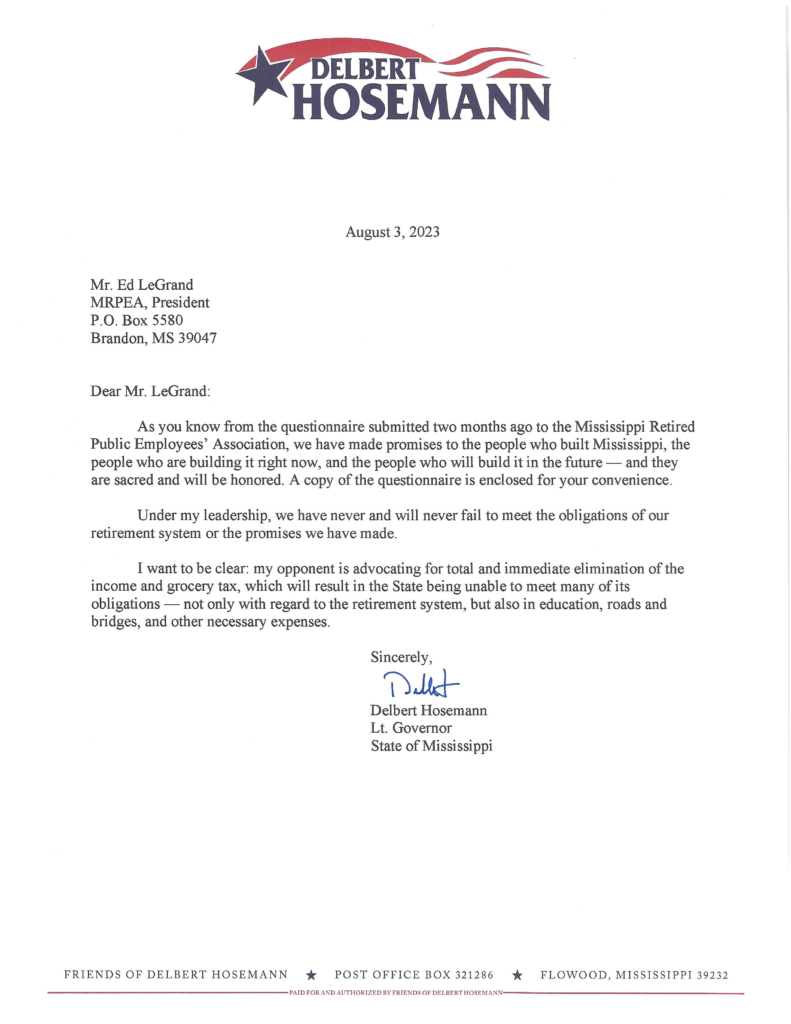

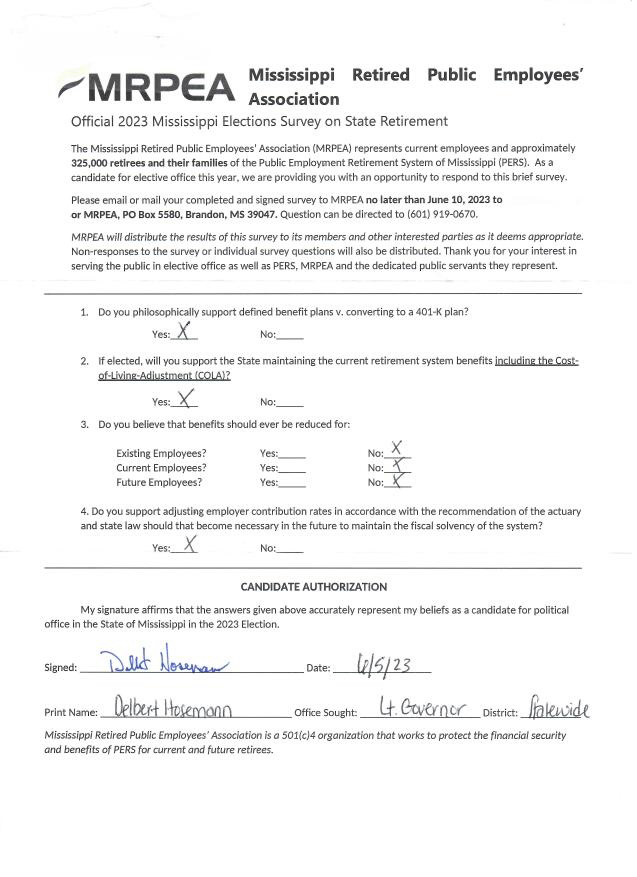

Thank you for your support, Lt. Governor!

2023 PERS Board Retiree Seat Runoff

Ballots for the retiree representative to the PERS Board of Trustees will be mailed out on March 17, 2023. The deadline for receipt of ballots is April 21, 2023. The candidates in the runoff are George Dale and Bonnie Granger. Having retired members on the PERS Board that support maintaining existing benefits of PERS for current and future retirees is critically essential. To assist retiree members in making an informed decision, MRPEA is providing Candidate Qualifications, Candidate Surveys, and historical information about the recent vote of the PERS Board to increase employer contribution rates:

Candidate Qualifications: The work of the PERS Board involves complicated financial, legal, and administrative decision-making focused on maintaining the financial integrity and benefits of the retirement system.

George R. Dale (Clinton)

• Mississippi College, master’s

• Mississippi Department of Insurance, commissioner

• Moss Point High School; teacher, coach, and principal

• Administrative Assistant to Governor Bill Waller

I am completing my first term as a member of the PERS Board. It has been an honor to serve. During my term, I have not missed a board meeting. When I started on the Pers Board, we had a cash reserve of approximately 26.5 billion dollars. That amount has increased to around 36 billion dollars. This board has been very conservative with your retirement funds. I have championed the idea that retired teachers collect their pension, but be allowed to work under contract with the public school system. I would appreciate your vote. George Dale

Bonnie J. Granger (Ocean Springs)

• Loyola University School of Law, Juris Doctorate

• University of Southern Mississippi, master’s

• Hattiesburg Public School District, chief financial officer

• Certified Public Accountant

• Attorney, Mississippi and Louisiana

I have vast knowledge and experience in government finance. My career began with the State Auditor’s Office and transitioned into public school district finance, where I served three districts as Finance Director. I received my Bachelor’s and Master’s degrees in Accounting from the University of Southern Mississippi and my law degree from Loyola University. I am a licensed CPA and an attorney in Mississippi. My experience gives me an unparalleled advantage in understanding the PERS system. I strongly support maintaining both the health and member benefits of the PERS system for current and future retirees. Thank you for your support.

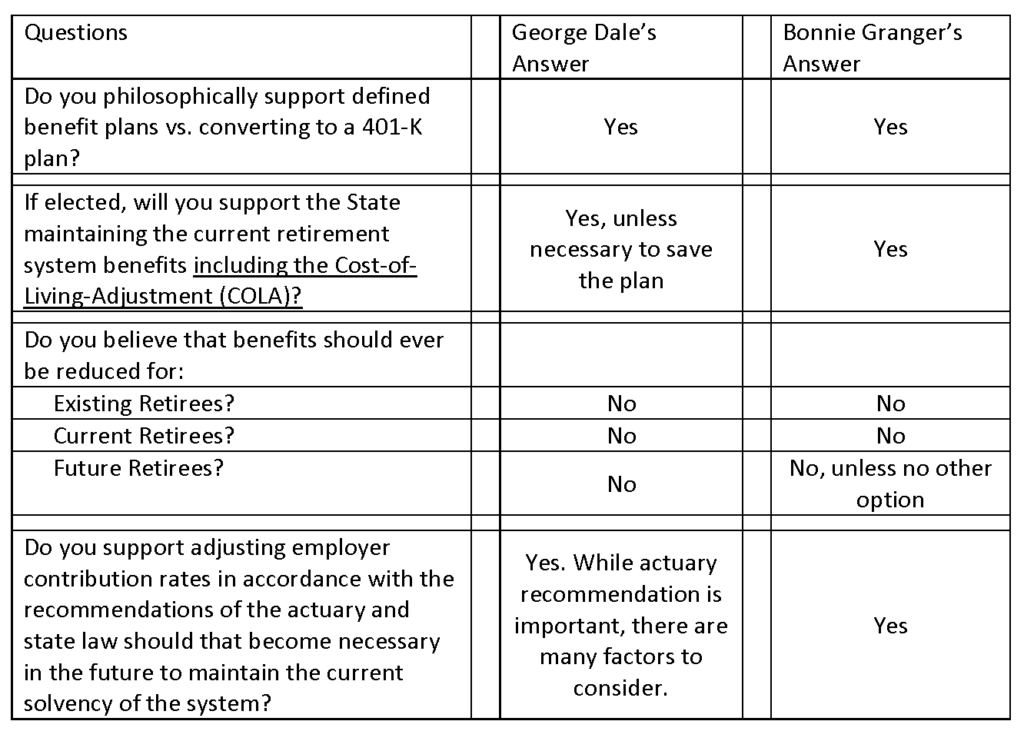

Candidate Surveys: MRPEA conducted surveys of each candidate to assess their support for maintaining current retirement system benefits. Members are urged to review the full response of each candidate to the survey. Below are the answers from the survey typed for viewing.

Recent vote of the PERS Board to increase employer contribution rates: At its meeting on December 20, 2022, the PERS Board, based on recommendations of the system’s actuaries and staff, voted to increase employer contributions to make PERS benefits sustainable now and into the future. An excerpt from the PERS Board Meeting Minutes that includes the vote of each member is below for your review.

_____________

Minutes | Board of Trustees

Public Employees’ Retirement System of Mississippi

December 20, 2022 | PERS Board Room

Page 4

Motion: To increase the Public Employees’ Retirement System of Mississippi employer contribution rate from 17.4 percent to 22.4 percent as of October 1, 2023.

• Made by: McCoy.

• Seconded by: Hanna.

• Discussion: None.

• Voting for: Benson, Breland, Hanna, Howard, McCoy, Rutledge, and Smith.

• Voting against: Dale, Graham, and McRae.

• Absent: None.

• Duly Passed

_____________

Please check your mail and complete and return your ballot right away after carefully reviewing all of the information provided here. Make your choice for the person you believe will best serve the interests of current and future retirees. Also, please encourage other retirees to vote as well and share the information provided in this communication. Thank you in advance for your participation in this very important election. Your voice matters!!!